Money nerds love the beginning of the year.

Personally, I am psyched!

I can start contributing to my retirement accounts again, my tax refund is just around the corner, and I can set some crazy lofty money goals for the year.

Don’t miss out on some of this joy I’m experiencing.

Here are 28 things you can do now to get your financial year off to a great start.

How to Improve Your Finances This Year

1. Find Your Problem Areas

I got 99 problems and Chipotle ain’t one.

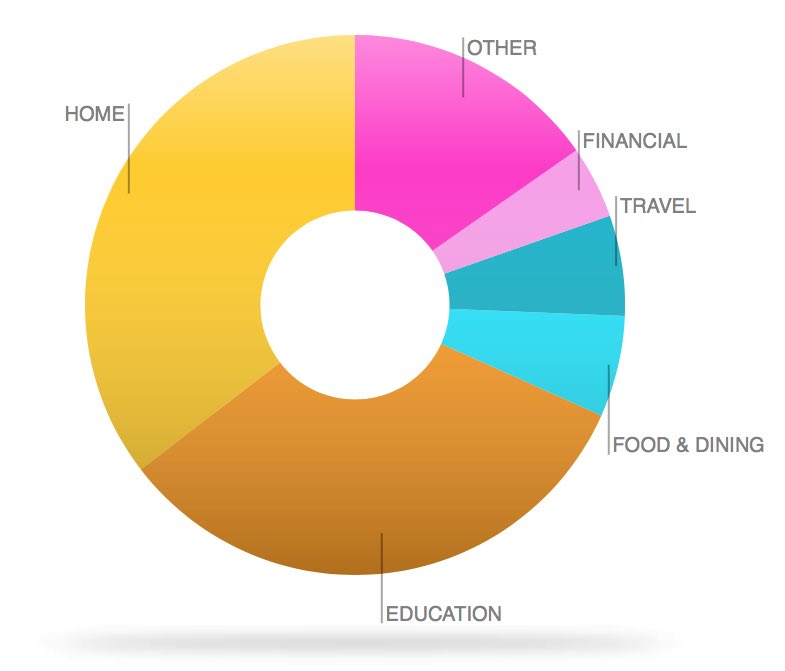

In 2015, Mint.com told me I had a Chipotle problem.

I fixed that in 2016 by bringing my lunch to work more. (The Norovirus scare also helped ha).

I didn’t fix all of my problem areas in 2016 though.

Travel still remains a ridiculously high expense for me.

I’m going to take it down a notch in 2017 by staying put more.

I recommend Mint for tracking your spending by category. It’s free!

2. Track Your Net Worth

How many of you know exactly what your net worth is?

If you’re a money nerd like me, you already have Personal Capital.

Personal Capital aggregates all of your accounts for free.

Watching that net worth number go up, motivates me to do better.

My net worth apparently went up $6,000 since I published this net worth post.

If you start tracking your net worth, you have a number to baseline your progress.

For those of you new to this site, consider signing up for a free account with Personal Capital so you can start tracking yours.

3. Pay Off Your Debt

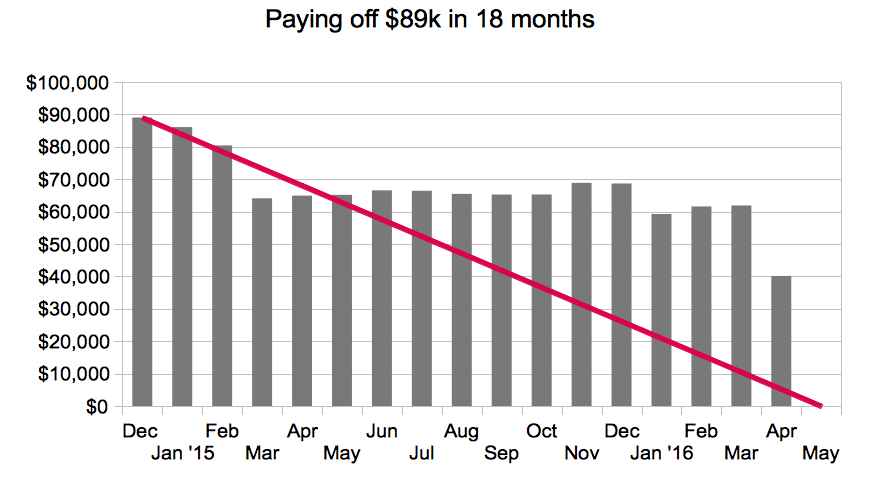

If you think my net worth looks good now, it wasn’t always this way.

I’m coming back from being $89,000 in debt.

I recently paid off my debt and my husband’s debt including our student loans, car payment, and 0% interest credit cards.

It’s really hard to get going financially when you have debt hanging around your neck.

Make 2017 the year that you knock out the last of your debt!

Create a spreadsheet and plan out your debt reduction month by month.

Also, consider signing up for student loan refinancing through SoFi.

Why pay 6.8% (federal interest rate when I was in college) when you can pay much less and save money over the length of the loan?

Take SoFi’s survey here to see if they can help you.

4. Make Cash on the Side

There are two kinds of people in this world.

The people who think all day about what side hustles they could do and get discouraged/overwhelmed AND the people who don’t give a crap and just pick one and try it out.

In 2017, you and I are going to be in that second group.

Don’t psych yourself out trying to think of what is going to work and what isn’t. Just pick something and try it.

Text two friends right now and say “hey, I’m starting a dog-sitting business. If you or anyone you know is going away for the weekend, I’d be happy to watch your dogs for $40 a day.” Or whatever it is you want to try out.

If no-one bites, move on to something else.

You’re never going to know what works until you try.

99% of side hustling is just getting started.

5. Make Money Online

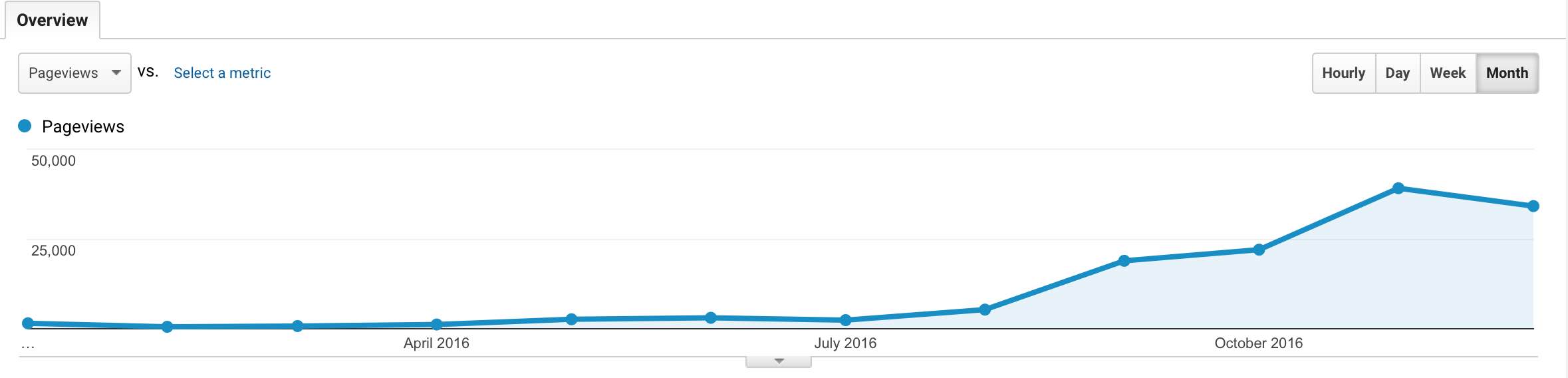

In 2016, I realized that I could actually make money online.

This is not my first blog but it’s the first time I ever made money blogging. I started this blog by buying a domain name and the cheapest web-hosting offered on Bluehost.com.

I started the blog to keep me accountable while I was paying off my debt and now it’s making money for me. I made thousands of dollars on this site per month.

Here are the tools I use to make money on this website.

If you don’t know how to start a blog, here is my tutorial on starting a blog.

I made $25,000 blogging last year.

6. Reduce Your Bigger Expenses

If you want big results this year, you have to go big.

If you’ve already eliminated your extras such as cable, figure out what else you can do in 2017 to improve your finances.

Many of us feel irrationally guilty about spending the extra money for a latte, when the majority of our money goes to housing and transportation.

Last year my husband and I sold our SUV, downsized, and sold $4,500 of our belongings on Craigslist and it made a huge difference in our spending.

We’re going to be making some big moves this year too.

Figure out how to reduce the bigger expenses and you’ll be in better shape this year.

7. Go Job Shopping

It’s January!! Company hiring budgets reset at the beginning of the year.

Take some time to go job shopping this month and see what is out there!

8. Negotiate Your Salary

I negotiate my salary with every move I make. Here is exactly when you can negotiate and when you can’t.

Whether you’re going for an internal promotion or an external opportunity, be bold and negotiate your salary.

9. Track Your Business Expenses

Remember that side-hustle you’re thinking about starting?

Well if you start it, you can probably deduct some of the expenses you’d have anyways such as your cellphone, internet, etc.

I will be deducting my blogging expenses in 2017.

10. Eat Better and Save

Part of eating better is planning better.

I get all hangry when I haven’t planned anything and just want to pick up a pizza.

Stop putting yourself in that situation by planning out your meals for the week.

One thing that has really helped us is doing more crockpot meals.

My husband puts meat and some liquid in the crockpot before going to work

We get the recipes from Pinterest and The Everything Paleolithic Diet Slow Cooker Cookbook![]() .

.

This is the super-cheap crockpot we use:

6-Quart Oval Manual Portable Slow Cooker, Stainless Steel![]()

11. Contribute to an IRA

IRA stands for Individual Retirement Arrangement.

I totally thought it stood for Individual Retirement Account for the longest time! Haha oops!

Traditional IRAs are awesome though because they put more money in your pocket both now and in the future.

You can contribute up to $5,500 to a Traditional IRA in 2017 and can deduct it on your taxes.

This means that you get some of the $5,500 back at year-end because your contribution was with money you already paid taxes on.

*You probably need to read a little more about IRAs if your income is over $60,000, just to make sure you qualify for the deduction.

(I’m no advisor, let’s be clear, just trying to make it simple).

You can set up an IRA online with a company like Vanguard or Fidelity. I like them because they have cheap funds.

12. Sneak in an IRA Contribution for Last Year

2016 didn’t quite go as you planned? Hey good news! You can time-travel back to 2016 and make it better financially.

The IRS allows you to make your IRA contribution for 2016 up until April 18, 2017.

When you set up an IRA with a company like Vanguard, they let you choose whether your contribution is for 2016 or 2017.

Super easy.

I think there are many things in our lives that some of us would like do-overs on.

Here’s your chance.

13. Figure Out a Plan to Max Out Your 401(k)

If you’ve never maxed out your 401(k) before, this is The Year you’re going to do it!

You can contribute $18,000 to your 401(k) annually and ALL OF THAT MONEY is tax-deductible. Regardless of your income.

Take $18,000 and divide by your annual salary. That is the % you should be contributing to your 401(k) per paycheck to max it out.

14. Front-Load Your 401(k)

Now, if you want to get all fancy, you could front-load your 401(k) too.

What that means is that you contribute more money to your 401(k) in the beginning of the year and let those earnings compound on each other all year long, leaving you with more money than if you had contributed evenly every paycheck.

It can get a bit tricky if you have an employer match that requires you to contribute something every paycheck to get the full match.

It can easily be figured out in Excel though.

I created a spreadsheet that figures it all out for me.

15. Open a Solo 401(k)

Do you have a side-business? Maybe selling stuff on Craigslist, pet-sitting, mowing lawns, or blogging.

You could technically run that business as a sole-proprietor and shield your earnings from taxes by contributing to a solo 401(k).

It’s pretty easy to open a solo 401(k). You can do so through companies like Fidelity.

I recently opened a Solo 401(k) and now I can put 25% of my side business income tax-free into the solo 401(k).

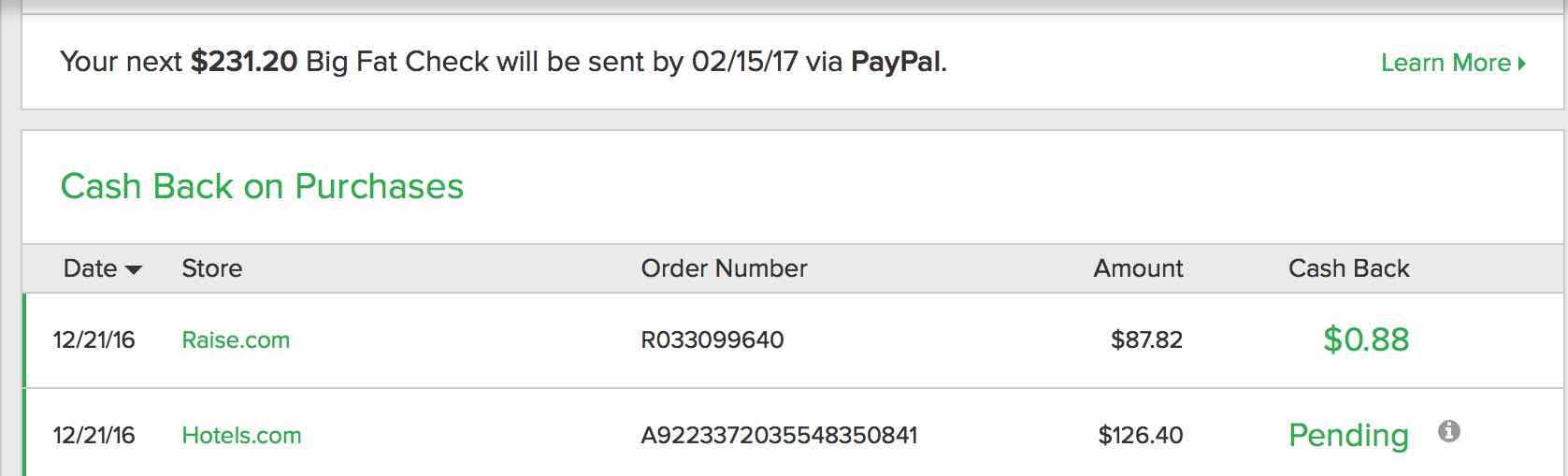

16. Get Cash Back When You Buy Stuff with Ebates

You’re going to have to buy some stuff this year, might as well get cash back for it.

I use Ebates for cash back and love it.

They have every merchant on there from Amazon to Macy’s to Nordstrom.

I have the Ebates browser tool active so I can see when I am on a website that offers cash back.

Ebates also automatically scans for promo codes when I’m checking out. It found a 25% off promo code for me one time.

You get a $10 welcome bonus for signing up through this link.

17. Buy Gift Cards to Save an Extra % Off Your Shopping

Sites such as Raise.com allow you to buy gift cards at a discounted price.

I recently bought a Hotels.com gift card on Raise at 7% off when I hacked our honeymoon.

Sign up for Raise through my link for a $5 welcome bonus.

Raise has tons of merchants on there from Home Depot to Target, you name it.

18. Watch Your Credit Score Like a Hawk

I use Credit Sesame to keep an eye on my credit score.

A low credit score can affect your ability to rent an apartment or get housing.

I like Credit Sesame because it lets you see all of the accounts you have open under your name and emails you whenever something suspicious is going on.

It’s free to sign up for Credit Sesame so it’s a no-brainer.

19. Maximize Your Tax Return

Spend an extra 10 minutes researching what new tax deductions or credits you may qualify for before submitting your taxes this year.

Here is a starting point for commonly overlooked credits and deductions:

- Saver’s Credit for those in lower income brackets who also save for retirement

- American Opportunity Credit, Lifetime Learning Credit, Student Loan Interest Deduction, and Job-Related Work Expense Deduction for Educational Expenses

- Deductions for home office, business expenses, etc.

- Charitable donations

- Moving expenses

- Mortgage Interest Points

Oh and when you get your return, use it to pay off debt, fund your IRA, etc. Don’t spend it!

20. Shop Around for Better Insurance Rates

You could shop around for a better deal on car insurance, home insurance, etc.

Even if you don’t want to switch insurers, call them up and see if you now qualify for a reduction.

Perhaps your driving record is better or now that you’re married, you qualify for a lower rate.

21. Take Advantage of All Employee Benefits

Are you contributing to a Health Savings Account? It’s one of the ways you can become a millionaire the boring way since it’s triple-tax-advantaged.

Sometimes you have to dig a bit into your employer’s benefit documents to see what options you have available to you but take the ten minutes this month and save big.

22. Up Your Savings Percentage with Automatic Deductions From Your Paycheck

We have multiple bank accounts and have set up our paychecks so that we direct deposit a certain amount of money into each of those bank accounts.

The best way you can up your savings percentage is by taking out the money before you even see it.

I highly recommend this approach and it took me ten minutes to set it up.

23. Get Your Partner Onboard

For those of us in relationships, it can help big time if our significant other is onboard with our spending and savings plans.

Chat with your partner about your 2017 financial goals so you can make sure you hit them together.

24. Calculate How Far You Are From Retirement

I write about my plan to become financially independent and have the potential to retire before I’m 65.

This is called FIRE and it’s a thing.

If you want to calculate how far you are from retirement, I recommend using the free FI Laboratory over on the Mad Fientist’s website.

I also have a podcast about early retirement you might like to check out.

25. Improve Your Health

Poor health is super expensive.

Make 2017 the year that you get up off your butt and start working out again.

You don’t have to pay for a fancy gym membership.

Running is free! Woohoo.

Resistance training or weightlifting is even more effective than running and can be free once you pay the initial start up costs.

I have two kettlebells and some resistance bands that I use for at-home workouts.

I’ve also found great deals on used dumbbells and gym equipment on Craigslist in the past.

You can YouTube your workouts for free or you can pay a professional for a 4-week workout for around $50.

You need to share your goals, any injuries, and what equipment you have available to you in order to get a tailored program.

Don’t cheap out on your health in order to save money because it might come back to bite you later.

26. Don’t Get Carried Away with Spending for Major Life Events

The diamond industry has made a killing by convincing people they need a huge rock for their engagement ring.

The wedding industry has profited from the rhetoric that a bride should have her perfect white wedding.

Don’t get fooled.

We didn’t fall for the ring bait or the wedding bait and we’re totally fine.

If you have a big life event coming up this year, such as a wedding or a baby, try to separate emotions and excitement for the event with spending.

It’s super hard but so important to hitting your financial goals this year.

27. Pick Up Some Frugal Friends

Social events can get super expensive when people just want to meet for food and drink.

Hiking is free and a fun activity to do with friends. I like the site alltrails.com which can help you find highly rated trails in your area.

Figure out who your frugal friends are and try to steer spendy friends away from super expensive outings.

28. Write Down Your Goals

My husband is more of a visual goal-setter.

He bought a big whiteboard for our apartment, despite my pleas that we didn’t need it, and we both love it.

He also has this Panda Planner which he uses daily to track his goals, organize his day, and even do exercises in gratitude.

I bought my sister one for Christmas and she swears by it as well.

This is the one we bought and you can actually use the code PANDAFAM to get an extra 10% off if you’re interested.

I hope that 2017 is the best year for you yet!

What are your financial goals for 2017?

- How to Make a Backyard Movie Theater with a projector screen - September 19, 2020

- HONEST Passive Income Planner Girl by Michelle Rohr course review - May 25, 2020

- 35 Pink Aesthetic Wallpapers with Quotes and Collages - May 20, 2020

Good points all!

In addition to ebates have you tried using evreward.com? It shows you all offers currently available for a particular store (including ebates, airline shopping portals, credit card portals etc.) so you can pick the one with the best offer on that particular day.

No I haven’t! Thanks for letting me know about it.

Getting your spouse on board was so important! Things turned around for us financially and for our relationship when we had “the talk” about money.

We just added kiddo #2 to the bunch last year. Preparing for her arrival with a minimalistic and frugal mentality kept our expenses much lower than our first.

Congrats on your second child! Ha yeah I feel like we’ve had the money talk a lot in our relationship and it’s changed over time.

A nice easy way to double dip two of those goals is to do a side hustle, then put all that money into a deductible IRA, if you’re eligible for it. A nice way to put that side hustle money to work in tax advantaged investments. Plus, if it’s a side hustle, presumably, you don’t need any of that money in order to live.

Yup! Is that triple dipping haha! I like the sound of it 🙂

Great post that covers all the bases!

I’m still in the process of getting my GF on board with improving her finances this year. It’s been a struggle thus far but its slowly getting better. She recently set up a high-interest savings account and automatic savings plan for Christmas 2017. It’s a start :).

I’m going to check out that Panda Planner! Looks great!

That’s awesome! Yeah it wasn’t an overnight thing for us either. It took my husband probably two years to start reading blogs and getting into it. He is still nowhere near as interested as me. I was lucky though because he was the frugal one out of the two of us naturally!

Great advice. Please dedicate a post on how to set up solo 401(k) as sole proprietor, I didn’t know you could do that.

Yes this is a great list Julie! You touch on so many important points on how to save our money and make it work for us. There is not one way to save on our road to financial independence! I might I have to look into Personal Capital now. I talk about net worth on my blog as well, so I would love to know exactly what mine is. I speak about net worth in my post How I Plan To Pay 28k in Debt in a year as a Student: http://www.themindfulrise.com/student-loans/

This is an awesome list, Julie! You sure know how to encourage everyone to get their financial year off to a great start. What I like is that you put finding problem areas in number, which I think should be the first thing everyone should do. How can you improve your finances if you don’t determine your problem areas first, right?

In relation to tax deductions, I would like to add that family caregivers have tax breaks. Adult children must claim that their parents are their dependents and that they are paying for at least have of their parents’ living expenses. Another overlooked tax deduction is long term care insurance premiums. For more specifics, you can check out my latest blog post about these tax deductions.

Good to know about those tax deductions! Thank you for commenting.

for #21 about the 401k roth conversion. I’ve found a form from my employer called the 401k rollover request, does that sound right?

I think the form from my employer is called in-service withdrawal. See if you can find anything about in service withdrawals (meaning you still work at the company but you can take money out).

I love crockpot meals! My wife and I mainly eat paleo and find that it’s not easy to find low-cost meal options. Proteins and whole foods (the actual food, not the store :>) seem to cost a lot more than less healthy options. At least here in our area.

Great article!

Thanks for the Mint recommendation! Great app! I’m loving it so far.