Cheers! Today I am DEBT FREE.

It feels so good to say that after spending the last year and a half of my life paying off some serious debt.

My debt consisted of a mix of student loans, car loan, and credit cards – specifically the nasty 0% interest credit cards that trap you.

I accumulated much of the debt when I received a big promotion in 2014 and then went on a spending spree that included a big house, car, and dog.

Between that and the student loans, I put myself into $53,000 of debt.

Then, my fiancé proposed and I inherited $36,000 of his student loans!!

Together we owed $89,000!

I didn’t want to get married with debt and created a plan to get rid of my part of the loans right away.

I found inspiration and got moving!

I stumbled upon the blog No More Harvard Debt and was completely inspired. If he could crush $90k of debt in 10 months then I could certainly crush mine. There was no reason that I needed to be living this ridiculous lifestyle in my twenties. So I sought out to change that.

I also found the blog, Mr. Money Mustache, around this time and the post “News Flash: Your Debt is an Emergency” lit a fire under my @ss so to speak.

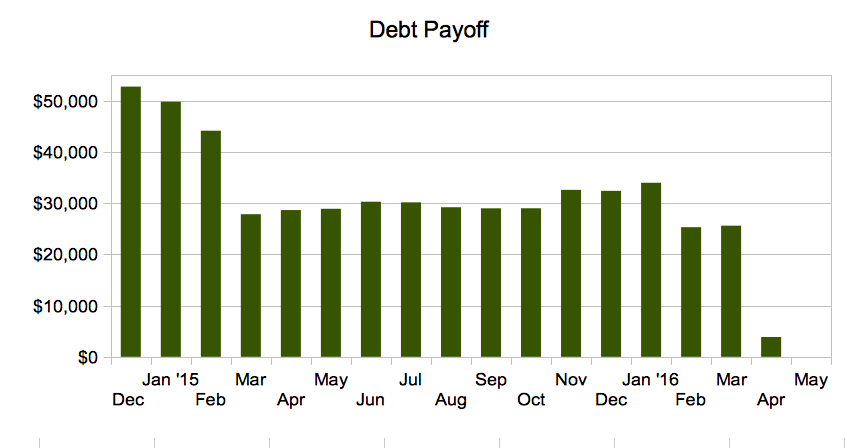

It took me 18 months to pay off the debt and it didn’t look pretty. I wanted a nice little downward slope the whole time like you see in other blogs but my debt journey wasn’t like that.

I had long stretches of time where my debt flattened out and some stretches where it even increased (such as last fall when I needed emergency surgery). Nevertheless, I was able to tackle $53k of my debt in record time.

Below is a graph of my debt payoff over the last 18 months.

After I finished paying off my loans, I made the decision to pay off my fiance’s loans too. It was a hard decision but one that was right for the both of us.

I paid the $36,000 of his loans within 30 days of paying off mine!

I then paid off nearly $7,000 that my parents had in Parent Plus loans from my education.

This added up to nearly $100k of debt TOTAL.

How I paid off the debt so quickly

Now to the important part, how I paid off the debt.

I am not going to start with talking about how I reduced my lifestyle and cut back on consumerism. Obviously, I did those things but for me, it wasn’t the #1 strategy behind how I paid off my debt.

The #1 strategy behind paying my debt was increasing my income.

I graduated from college with a liberal arts degree and three non-profit internship experiences under my belt. I wasn’t the prime candidate for a high-salary job.

Nevertheless, I have been able to go from my lowest of getting paid $9/hr in 2012 to breaking six-figures in 2015.

The extra income has allowed me to pay off my debt more quickly.

I’m also blogging and bringing in a few thousand dollars in passive income each month from this website (although I started making money from the site after I had paid off my debt).

Related: How to Start Your Own Money-Making Blog

Increasing your income is a strategy

Now before you click off the page – give me a second to hear me out.

There is much reverence for frugality in the personal finance world. There seems to be a disdain for high income.

I often see in the comments section of popular blogs I read, “well this is impossible for me to repeat because you have such a high income” or better “it was easy for you because of your income.”

In my opinion, increasing your income is a strategy within itself. Just like frugality is a strategy.

I didn’t land a cushy job right after college. I didn’t have the right major or connections to lend itself to a high-paying job. I also knew nothing about blogging when I started my first blog back in 2012.

Everyone has a different strategy for debt payoff and all are good, valid strategies, but I figure that the “increasing income” strategy needs a post too.

How I increased my income to pay off the debt

1) I learned new skills

When I first graduated from college, I had no technical skills. My liberal arts degree taught me to think, to write and to communicate (all things I am grateful for) but I didn’t learn any concrete, technical skills.

That changed when I started creating versus following and teaching myself new skills in that process. Through starting my own website, I learned search engine optimization, creating a social media community, a bit of html/css, and WordPress.

Fast forward a few years later later and I am now in a more technical role which requires additional skills. I have been pursuing my Masters Degree online, reimbursed by my work, and I also have created this new blog that brings in passive income each month.

Whether you pursue formal education or just Google stuff, learning in-demand skills will prove valuable in increasing your income.

Related: Why I Skipped the MBA And Got An Online Degree in Tech

2) I switched into an in-demand field

Despite my background in non-profits and a liberal arts degree, I was able to land a great job in an in-demand field because I had been working on improving my technical skill set and I figured out how to ace interviews.

I also was not afraid to jump into blogging, a field I knew little about.

I now find my career very rewarding and I’m never bored.

If you think it’s *too late* to change your field, you’re probably wrong. Increase your skill-set and learn how to sell your unique background to recruiters/hiring managers and you’re golden. You just need one opportunity.

3) I got promoted

Whenever I start a new job, my goal is to get promoted as quickly as possible. I have a few strategies for how you get promoted but the best ones are to give your manager opportunities to see you shine and to stay visible in the office.

Networking with people did not come naturally to me but it’s something that I’ve worked on over time and now it’s second nature. It has definitely helped me get better opportunities.

4) I changed jobs

Wage compression is when a company pays people coming in more money than the people currently in the job because the market rate for the job has changed and internal raises are not enough to keep up.

Wage compression is why the new guy makes more money than you.

Switching jobs is a way to combat wage compression and to get the big increases in the process.

At the same time though, maximizing your opportunities at your current employer before you leave is important too.

Many people don’t see the opportunities to make more money and get more responsibility where they are and end up job-hopping more times than they need to. Or they switch jobs but neglect to negotiate their salary.

Others forget that personal happiness is important too. Make sure the job is a good fit before you jump at it!

5) I sought opportunities

This one is probably the most important. I am always on the look-out for new opportunities.

I regularly attend conferences and they often lead to job opportunities.

When I’m at a conference, I talk to everyone – from people on the bus to the recruiters in the career booths. You never know where your next opportunity will come from.

It’s uncomfortable to put yourself in situations like this but it can really pay off.

I’ve attended conferences for my career in tech and for blogging.

6) I cut down on spending

Now to the normal debt payoff strategies. I reversed my consumerism where I could and cut down on spending.

I recently sold all of my furniture on Craigslist and I sold my car.

I didn’t need any of the material items and I haven’t missed them since.

I also lived with a roommate for years which decreased my spending on housing.

And now I’m debt free!

My next step is to decrease my spending while continuing to increase my income so that I can grow our savings faster.

Refinance Your Student Loans

I looked into refinancing my student loans and think that is a great option for someone who thinks it will take at least one year to pay off their student loans.

If you’re thinking about getting a better interest rate for your loans, I recommend SoFi which is a company that does student loan refinancing.

I paid a 6.8% interest rate on my student loans and wish I had looked into refinancing sooner. I might have qualified for a lower interest rate, which would have saved me thousands.

When you refinance, you put more money each month towards the original balance of the loan because you have less to pay in interest.

So far I’ve helped over 100 readers save thousands on their student loans.

Sign up here for the SoFi questionnaire.

Other ways to get rid of debt fast

If you are willing to put in a little hustle, you can make a significant dent in your loans. Here are a few strategies you can use to pay off your loans.

Start a blog or website.

Nothing kept me more accountable to paying off my debt than posting the numbers on my blog each month. If I didn’t make progress on my debt payoff, I was embarrassed. Blogging held me accountable.

If you think you need the extra accountability – sign up for the cheapest web hosting offered through Bluehost and start a debt blog of your own. I wrote a guide, How to Start A Blog of Your Own, to help you get started.

As an added bonus, you could make some extra money from blogging which you can put towards your debt. I made $800 on my blog in January and $1500 on the blog in February, which still blows my mind.

Track your debt payoff.

I track my money using Personal Capital which is a free tool that aggregates all of your credit cards, bank accounts, loans and investments into one dashboard. I downloaded the app which is really easy to use.

My favorite feature is the net worth tracker which gives you an accurate picture of where you stand financially. It also tracks your spending so you can see where your problem areas are at the end of the month.

I recommended signing up for Personal Capital. The visual representation of your progress is super motivational.

Related: I’ve Saved $26,000 in Seven Months

Save when you spend.

I don’t buy anything online without checking to see if I can get cash back on it. For example, I sent someone flowers recently and I was able to get $10 in cash back on the purchase.

The cash back program I use is Ebates and it’s free to sign up.

If you download the Ebates browser tool, you can automatically see when any website you are on offers cash back. Most of the major online shopping retailers offer cash back nowadays.

You might as well get cash back on stuff you need to buy anyways and use the savings to pay off debt.

Sign up for Ebates for a $10 welcome bonus.

What strategy do you (or did you) use to pay off debt? Any advice for other readers in debt?

- How to Make a Backyard Movie Theater with a projector screen - September 19, 2020

- HONEST Passive Income Planner Girl by Michelle Rohr course review - May 25, 2020

- 35 Pink Aesthetic Wallpapers with Quotes and Collages - May 20, 2020

You are very wise to upgrade your skill set as well as transition jobs at the correct time. Moving from one company to the next can give a massive salary increase and it is incredible how quickly your income grew. People fail to realize that they will not be successful straight out the gate. You definitely worked hard to get where you are so congrats to you!

Thank you! Much appreciated!

Just saw your comment on my post so ran (will clicked really quickly) over here to say CONGRATS!!! This is incredibly inspiring and I’m so amazed by how quickly you both increased your income and paid off your debt. $53k gone is 18 months, man, that has to feel amazing. I can’t wait to get my hand’s on Peach’s debt so we can work together to rid us as a couple of the negative balance sheet! That, however, is waiting until we’re legally tied to each other. 😛

Thank you!! It feels great!! Yeah I totally understand the excitement you’re feeling to get rid of those loans! My fiance has student loans left as well. Still figuring out what we’re going to do about those and when but I can’t wait!

I did the same thing with my liberal arts background, and I don’t regret it. Majored in history in undergrad, and definitely spent some time after gaining more technical skills. Now I work in statistics/economics, so it’s a 360 change from history, but I don’t regret a thing! 🙂

Wow yeah very different fields! I don’t regret my liberal arts background either even if it meant I had some catching up to do later on.

Wow this is incredible to read! Congrats! I am definitely in the “increase income” camp and I think it’s the best way to pay off debt, build savings, invest money, etc. I’ve been promoted a few times the past few years but I’m not necessarily expecting anything for at least 2 years at my current company. I totally agree about wage compression. I think you get penalized for staying at the same company because they have a lot of data on how much you’ve made. I wasn’t that happy with what my increase was in my last promotion. I really like the company I’m at – it’s the only one I’ve ever worked at – but it’s so true that you get penalized for staying at your current employer. I think that’s true of every company and I don’t think my experience is unique.

Yup! I saw some HR slides from Netflix that were circulating LinkedIn that showed their philosophy of not giving raises but evaluating comp at year-end compared to market rate. If you were below market, they automatically bumped you up. It’s a very interesting philosophy. Would love to talk to someone who worked at Netflix to see if it worked!

Well done! I haven’t been able to increase my income over the past decade, but my husband has. How? He taught himself new skills and changed employers a few times. Now he’s not just making more money, but So Much Happier! (and that makes my life a lot happier, too!)

Now, to fix my glass ceiling …

Thanks! and glad that it’s working out for your husband! Good luck to you! Maybe 2016 is the year!

Wow! That is really excellent work! Your efforts on the debt payoff and your approach to work life are terrific. Now to build up that savings!

Thank you!!

Awesome work! I’ve also concentrated on increasing my income as well. What I recently struggled with was pursuing a job for a lot more income but most likely a lot more hours and stress. I decided the extra income wasn’t worth it for me since I want to enjoy the journey to FIRE (at least a little bit).

Curious you mentioned you have a big house – do you still have mortgage debt?

Thanks! Yup I still have a mortgage and my house went on the market Sunday! So I have that and then paying off my fiance’s debt until I’ll truly be debt free. I’m hoping both of those things can happen in the next two months!

Congrats on paying off your debt. For the first time in my adult life, I actually enjoy my full-time job. I need the test the waters out because I know an income boost will help me eliminate my debt much faster.

Oh man! A job you love is hard to walk away from!! Maybe you can optimize your income outside of your full-time job.

Wow! Congratulations! What an accomplishment! I’m very well with you on increasing income. One of the main reasons I side hustle is because I’m not interested in reducing expenses anymore than I already have. I’m already frugal by nature, don’t shop much, and don’t spend money on a bunch of things I don’t need. Drastically reducing my expenses any further just seems like plain torture and it’s something I’m not willing to do. So increasing income is definitely a winner when it comes to paying off debt.

I’m with you! Increasing income is a great strategy. I had some wiggle room recently to cut expenses so I did that too but now my focus is on not taking on any additional expenses and increasing my income further.

Wow, that’s impressive! Congrats on being debt-free!

Thank you!!

Hey, huge congrats being debt free. That is a massive achievement and well done on getting there.

You’ve done a great job with your earnings, nice! Earning more income is great, but I’d say why not pair that with living efficiently as well (not to get lifestyle inflation)? Which I believe, reading your responses to comments, is how you’ve approached it.

Very inspirational, nice job!

Tristan

Thanks, Tristan! Yup I’m working on a bit of a lifestyle deflation right now. Just sold the car, furniture, and now trying to sell my house!

Wow, you’re going to have nothing left! I hope you’ll be replacing some of what you sold lol.

Tristan

I wish this were true! Currently sitting in a 1bedroom apartment that looks like an episode of hoarders. Turns out downsizing from a 4BD to a 1BD is much harder than it looks. I’m starting up the Craigslist fire sales again.

Amazing story!

So happy for you and well done!!!

Coming from a guy that currently works in a laboratory, where would you say is the best place to start if I am wanting to learn more about technical areas (SEO, WordPress, etc)

Blogging and working in the tech community is something that I wish I would have done, but I ended up in healthcare.

What is your opinion?

Again great job and looking forward to reading now about you building wealth!!!!

-KB

Thanks, Kevin! The best site I have come across for SEO, WordPress, etc. is Neil Patel’s blog. He has some lengthy, informative articles on there that are very helpful. However, I think the best way to learn this stuff is to learn by doing. Playing with your own site and tracking metrics as you make changes can go a long way. I used to do that religiously with my old site but haven’t had the time to really dedicate to this one.

As for switching to a technical field professionally, that may require some heavier course material – depending on what you want to do. If you want to move into Web Application development, so designing websites, you can learn online (or through books such as Murach) and create a portfolio of your work. If you want to move into project management or software engineering, you may need to take some accredited courses either at a community college or online. There are the “coding boot camps” which many people do. They’re expensive. I would figure out if you want to be an actual engineer or not first. I’m not an engineer but I work with them and enjoy it. Hope this helps!

Wow this is amazing! Congratulations! You must feel like flying now that the weight of all that debt is off your shoulders. Soon enough your net worth will be able to pass mine. Excellent work!

Thank you! Yeah it feels awesome! You’re killing it with the net worth! I’m hoping to be in a good spot after we sell the house. Luckily I have been stashing money away in my 401k for a few years now. This is the year I start investing outside of the qualified accounts too!

Congrats! That is an amazing accomplishment! When I paid off my loans last year, the main driver was extra income that I brought in. You can make infinite amount of income but can only cut so much in expenses so if you concentrate on income, your upside is higher! Looks like you are killing it in that department.

Thank you and congrats on paying off your loans last year!!

Yes yes yes to all of this! Writing about increasing your income can be taboo sometimes and I think that’s crazy. We should all be implementing a special strategy to both save money AND make money. There’s nothing shameful about increasing your income- your hard-working self deserves to see great results!

Congratulations on the big debt payoff. Definitely sharing!

Thank you for your support and for sharing!

What an inspiring story! I agree that in the PF community there is a strong bend toward frugality and a somewhat negative stigma attached to earning more. You’ve definitely shown that it’s possible to do both. Congrats on paying down your debt and working toward full financial independence. Looking forward to reading more about your journey!

Thank you!

Congratulations! This is so inspiring to me since we’re close to being debt free. We just had this conversation last night that while frugality is a great start, like the coach to 5k, but increasing income is a great approach to the marathon. I think I’ll use this as a theme for a post. 🙂

Thanks! Love the couch to 5k reference! I had a friend who tried it and always wondered what it was all about! Good luck with your debt! Lowering your living costs is huge. Your blog has inspired me to live more minimally.

Julie – Congratulations! What a great feeling. I understand what you mean about the general view that it’s easy to save on a high income. And while it certainly should be easy, many many people with a high income are not saving an adequate amount of money. I think the best approach is one of embracing abundance and working to increase your income.

Thank you! Yeah it’s crazy. I was reading some article that 100 grand is not that much anymore and I laughed!

Julie – virtual high five to you. Love the focus on the income side of the equation. It is the best way to put wealth building on savings (pay debt down faster, and save faster). I wish I could convince more people to focus spend more energy increasing their income.

Also great to see another millennial killing it!!!

Thanks!! Yeah increasing income in the 9-5 doesn’t seem to be as popular as side hustles or frugality in the personal finance blog world. Kudos to you as well. Love the net worth tracker. Super inspiring!

Thanks Julie. I am sorry I haven’t been over here more often to read your content. You have some really good stuff going on over here. I have officially added you to my Feedly blog roll.

Something to think about…it would be great if you had the option for folks to subscribe to the comments, that we we get notified when you and others reply.

Cheers,

Dom

Thank you! Great idea regarding comments. I will have to look into that! Any plugins you recommend?

I freaking love money, I love earning more, I love the impact on my life! I’ve copped a bit of flak for saying so on my blog, but it’s the truth. Earning more has changed my life and only in a good way. Frugality can only take you so far.

Yup!! Not always the most popular route to take in the PF world but increasing income is a legit strategy. Bring on the wealth!

Hey, Julie!

Great article! I really like how you presented increasing income instead of just cutting back. I’ve been preaching that for years, even before teaching financial literacy at a local college. One can only cut back so much.

Don’t know why folks think making good money or side hustles aren’t for them. My degrees are in education, not the highest of paying fields, but not weak either. When we didn’t have enough money, I worked outside my 9 to 5.

Congrats on your achievements!

Looking forward to more great posts.

Until next time, Peace!

Thanks for the kind words! Yes increasing income can apply to anyone in any field. Side hustles are a great way to do that! Thanks for stopping by!

You’re awesome. Thank you for sharing! Having coming from studying social work and also working in the non-profit sector, I have moved towards new and in-demand schools. Teaching ESL online has been a great way for me to make good money on the side ($20/hour CAN). It has also allowed me to make my own schedule, work at home and provide a stimulating job where I get to educate young people 🙂

Wahoo paying off debt!!! 🙂 Feels gooooooood.

Woot Woot! You’re pretty awesome yourself!

I’m skeptical. An arts degree and earning $200k? The only girls I know able to do that have sugar daddies or are undercover escorts (and there is nothing wrong with either). As an individual you’re in the top 1% of income earners in the US.

People with STEM degrees who work in high tech fields do routinely make $100k – $200k per year.

Yeah, not an escort. You’ve inspired me to write a post about how this career path was possible for me.

Hi Tommy-

I met Julie a couple months ago and she’s exactly who she says she is. Don’t let the degree throw you off. Hard work and creative problem solving skills will quickly set you apart. Your boss will soon forget about where you went to school and what you studied.

My degree is in chemistry/biology and now, I’m a high earner in the IT field. I could tell you all about citric acid cycle, but 1s and 0s are what pay the bills now.

Thanks, Mr. 1500! Couldn’t have said it better myself! Problem solving skills and drive are what you need to succeed in the workplace – not necessarily a specific degree.

What do you do for job? I need ideas what kind of skills i should learn to increase My income. Thank you.

I’m interesting in what she did with a liberal arts degree, which usually is worth nothing in the work force. She isn’t replying to any post asking what field she works in. To be honest, she probably doesn’t even work anymore. The amount of money brought in by affiliate links and advertising on successful blogs can be astronomical. Some bloggers bring in $60,000 a month. A simple Google search will yield you blogger incomes. Mr. Money Mustache proclaims frugality, as do many of these FIRE blogs, but they make ridiculous amounts of money (and I’m sure dedicate a huge amount of time) to their blogs. The big successes of these people are their blog incomes from affiliates and advertising. I’d like to find a blog that doesn’t utilize any of these strategies. I’m 28 and married and we live very frugally and I make well into six figures and I’m having trouble with FIRE.

What annoys me is people who have no college degree or background on a subject being wildly successful on blogs on topics they know nothing about (not MB, but many others such as The Food Babe)

I think to myself “I could do that” but it is so hard to get a blog up and running with these big names out there that even experts in fields couldn’t usurp these self-proclaimed experts.

Hey Anthony – I didn’t respond to all of the comments recently because I got married, finished my Masters, and went on my honeymoon all in a 3 week period ha! I’m just starting to go back through everything now. I actually do still work and don’t make much money on my blog. I’d like to turn blogging into a profitable side-hustle for myself in 2017 though. If you want to find a FIRE blog without affiliates, check out my friend Gwen at Fiery Millennials. She is also in her twenties and is about 9 years out from FI.

@Edita I am a Project Manager. I recommend learning to code but data analysis is hot right now too if you don’t want to learn coding. I don’t code in my job.

Julie,

I love the idea of increasing the income. What are most in demand skills right now ? What would you recommend to learn. Congrats for starting FIRE journey. I am close to that too. I need to earn more.

Data analysis, IT Project Management, System Analysis are second to engineering/learning to code in my opinion. Also, hardware/server people aways seem to be needed but it’s less glamorous work sometimes (again that’s just in my opinion).

This is seriously amazing! You should be so proud of yourself for paying off that much debt. It just goes to show, you can do it if you really have the will and motivation. While I was in uni, I had to pay the last $25,000 of my degree out of my own pocket as I ran out of student loan help. I had 1 year to save it and was only working a casual job. I didn’t have any help from my parents but I worked by butt off taking more shifts at work and decreased my expenses so I could do it. Some people didn’t even believe I did it, but the fact I ran out of student debt and still finished my degree on time proves I did.

Amanda

Congrats! I wish I had the maturity and the badassity to think of doing something like that during college!

Excellent post!

I finished my last year with 5k of student debt loan. As soon as I started working I committed 80% of my salary to paying the debt. (I was living with my parents)

Now I’m totally debt free!

Wow! Congrats! This is very inspiring. I love your perspective on how increasing income is a strategy just like frugality is one. Loved it. This post definitely takes on a different strategy which I think it´s more doable than the others I´ve read. Thanks for sharing! 🙂

I am impressed by how fast you paid that off. In my country this is half the value of a decent home. And people spend 30 years paying for that. So you did fine.

“Wage compression is when a company pays people coming in more money than the people currently in the job because the market rate for the job has changed and internal raises are not enough to keep up.”

omg! duh! i didn’t know it had a name. i feel like it’s happening to me here… hmmm… what to do? what to do?

Your fiancee is lucky to have you! Networking is hard… when i used to go to conference I’d talk to as little people as possible… probably why I stopped going 🙂

It’s awesome that you were able to pay off your loan off so quickly. Your mentality towards spending money and a career path are very smart. Finding an in-demand career path and working your way up is the key to how you paid off your loan.

Also, making money on your own, without the need of a job, is incredibly important. Your blog made a great money and creates a second revenue stream. It also allows you to put more money down on your payments than the minimum.

Congrat’s Julie!!! ?