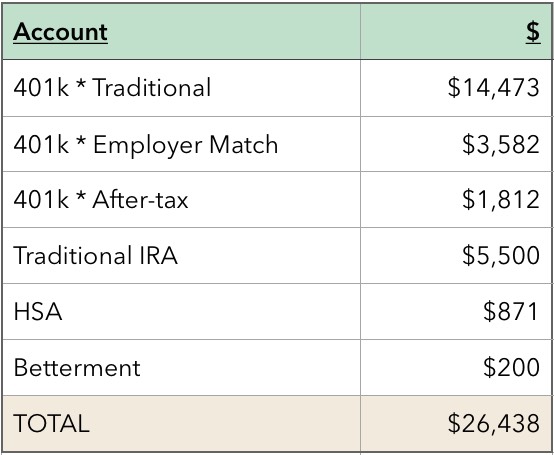

I’ve saved over $26,000 in the past 7 months. Even saying that number surprises me because it didn’t feel like I was saving that much at all! Below is exactly how I saved over $26,000 in 7 months which I know is not possible for everyone but something that actually happened to me.

First Choose Where to Save Your Money

The first step I took was to educate myself about all of the different places I could save money. I grew up in family where money was not discussed with kids – ever – so I felt like I had no idea what to do with my money as an adult. I didn’t understand where to save money, how to save it faster, and most importantly why I should even be saving money in the first place. It just wasn’t a conversation that we ever had as a family.

I became interested in money as an adult when I realized that I would be in student loan debt forever if I didn’t do something about it. One day I just finally had enough. I’m not sure what was the final straw but something snapped and I realized I didn’t want to be in this position forever.

I started learning everything I could about money from that day onwards. I spent hours and hours on Google, listening to podcasts, and educating myself about money.

Through my research, I found that there were places where I could save money. I could save money in a retirement account like a 401(k), an IRA which is another retirement account, a Savings account, and a Health Savings Account (HSA). I then started automating my savings in each of those accounts.

Where the past 7 months of savings went:

Automate your savings to make it super easy

After I increased my income enough to cover my savings, I set up auto-deposits directly into my savings accounts. I highly recommend that approach because then you are not tempted to spend the money.

The beauty of this approach is that it’s a quick and easy way to save more money. You don’t even have to think about setting reminders to deposit money periodically into savings accounts since you’ve automated the process.

But what if you don’t have the $26k to save?

Hard stop – this only works if you are able to generate enough extra income to save money. Most people simply don’t generate enough income to actually save $26k or more in 7 months. For this reason, it’s important to increase your income and that’s exactly what I did.

Once you reach a point where your income is significantly higher than your expenses, then you’ll be in a position to throw extra money into your savings accounts.

Here are 15 ideas on how to make extra money so you can save more.

1. Get cash back for things you’re buying online with Ebates.

Ebates has been a huge money-maker for me! It’s a cashback website where you buy things and then if you click through Ebates links before you buy them you get a percentage of your purchase back. I have $230 in cash back sitting in my Ebates account right now.

The key is to download their browser tool so you can see every time you are on a website that offers cash back. And if you refer three friends to Ebates, you can get a $75 bonus.

That’s $85 right there, plus all the cash back you will earn with your regular shopping. Of course, you can’t spend more than you should because that will cancel out the benefit of the cash back but it’s a nice bonus to get money back on your regular online shopping.

Sign up here for Ebates and get $10 FREE.

2. Sell items you don’t need to consignment shops and on Craigslist.

I made $4,500 in April selling stuff I had lying around the house. You would be surprised by how much money you can make with your extra stuff!

I sold everything from mugs to frying pans to furniture. It might sound crazy, but there are people out there who are looking to buy pretty much anything from home goods to furniture to appliances to knick-knacks and everything in between.

It takes a bit of hustle to sell stuff online but once you get going, the feeling is addicting and you can make some quick cash. The #1 tip is that people are flaky. Sometimes people say they are going to pick up an item and they never do! Be prepared to be a bit frustrated but it will be worth it in the end when you are able to get rid of things you aren’t using and make extra money.

3. Start an Etsy business

Okay this is my absolute favorite side hustle and I hope that I can sway some of you to start an Etsy business too! I actually started an Etsy shop a few years ago and I have made $6,000 since it opened!

I started selling temporary tattoos at first but then switched to selling digital files that can be printed and LOVE IT! My printables are actually scavenger hunts that bachelorette parties can print out and check off activities as they go on a bar crawl! It’s super silly but I charge $7.00 per game now and have made over $500 in a month!

I’m not a graphic designer but it was pretty simple to design the printable using a free online tool. I uploaded the file to my Etsy shop and my customers could download the printable hundreds of times after that with little action from me.

I don’t have to do anything really to maintain the shop but answer customer service questions and I only get a question once every few months. It only cost me 20 cents to start my shop!

Would you be interested in a passive side hustle like this? I have a free ebook about getting started selling printables on Etsy that I’d be happy to share with you. Download my free Etsy business ebook here.

4. Start batching your meals

I broke down and finally got the Instant Pot after my friends have been raving about it for a year. I hate to say it but I love it too! I guess this isn’t an “earn more” thing but it will definitely help you save what you earn.

I’ve been making meals in about 30 minutes and batching them for multiple days. The best part about batching is that it saves you both time and money. Since you can make several meals at once, you don’t have to spend time later in the week making additional meals.

Before, I used to get home from work and be too tired to make dinner and then order takeout. Now, I’m making more meals at home. I’ve accumulated a significant amount of savings from this one simple change. You can invest in an Instant Pot here on Amazon.

5. Save when you buy things online with Honey.

Honey is a browser extension that automatically searches for coupons when you buy things online. It searches for any code that may be available for you to use and save on your purchase.

I was just buying something online the other day and Honey automatically popped up with a coupon and it was awesome! It’s free to join and you get a $5 welcome bonus for signing up using this link:

- Sign up for Honey and get $5 FREE

6. Cut cable.

I recently cancelled my DirecTV subscription and now put that money towards savings. No one should be paying for cable TV when they don’t have to!

- I now use an HDTV antenna from Amazon so I can watch my favorite shows (the bachelor – guilty pleasure!)

- I get all of the channels I want to to watch (around ~40 channels)

You can still get your favorite premium channels by using a service like Hulu for Live TV.

Related: Saving Money with Cheap Alternatives to Cable (Sling TV, Roku, Indoor Antennas).

7. Start a blog.

Nothing keeps me more accountable to saving than having to post my numbers online each week.

At first it was kind of embarrassing to put myself out there on the internet but I’m so glad I did it. Blogging motivated me to achieve my financial goals.

I’m also making some extra money on the side from blogging. I started making a few hundred dollars per month and now I’m a six-figure blogger. It took three years to go from a few hundred dollars per month to multiple thousand but it is possible if you are willing to keep at it and never stop learning.

If you want to learn more about starting your own blog, check out my free 7-day course, How to Start A Blog Course.

Related: My April 2017 Income Report – $2851

8. Apply for new jobs and negotiate your salary.

I was afraid the first time I negotiated my salary but it worked! I’m now super confident.

Here is my story of how I negotiated my compensation.

The best part about negotiating is that it only takes a little bit of time (and a little bit of courage), but the benefits can be enormous. It’s possible to increase your salary by 20% or more just by being a bit stingy and asking for higher pay.

One thing to keep in mind when negotiating is that the employer doesn’t want to have to spend any more time or money searching for a different candidate, so you actually have more leverage than you think when it comes time to negotiate your salary.

9. Track your spending with the free app Personal Capital (and get $20)!

And try to stay away from your spending weaknesses!

Mine is Chipotle.

I used to go out to eat every day for lunch and it adds up.

Personal Capital is 100% FREE.

The net worth tracker is the best part of the whole app.

My net worth used to say negative $100,000 but with some dedication and time, it improved quickly. I’m motivated to keep saving when I see it go up each month.

10. Have a side hustle!

I’m all about side hustles and have a few extra income streams in addition to my day job.

Below are the ways you can side hustle in the next 15 minutes.

The more money you have coming in, the easier it is to save.

11. Practice the 24 hour rule:

If you are tempted to buy something, wait 24 hours and see if you still want it. If you still want an item after waiting 24 hours, give yourself permission to buy it. However, you’ll find that more often than not you don’t actually feel the impulse or urge to buy that item after all.

This simple rule allows you to keep more money in your pockets by avoiding impulse purchases and by forcing yourself to identify what things are actually worth spending money on.

12. Avoid social spending.

Invite your friends over to dinner instead of meeting out at a restaurant.

If you like eating out, try meeting friends for coffee or lunch instead of dinner and drinks.

This simple change can lead to a serious amount of savings without actually hurting your social life.

13. Get outside more.

Hiking, going to parks, and going to the beach are all cheap activities if you do them right.

Before you assume that you need to spend money to have fun, try spending some time outside in nature and you might realize that the great outdoors actually offers some of the best free entertainment.

14. Save money on travel by collecting hotel miles and airline points.

I no longer pay for flights and hotels after collecting thousands of points. I went on a 10-day trip to Europe with points.

15. Get a roommate.

I made $550 a month while I was paying down debt by living with a roommate. It wasn’t fun to live with a roommate as an adult but it was worth the money.

Pay off your loans so you can put that money towards savings!

I recently paid off nearly $90,000 of debt.

It was super hard but so worth it. I now have an extra hundred dollars going to savings each month.

If you still have student loans, consider refinancing them for a lower interest rate. It doesn’t make sense for everyone because you may lose some of the benefits of your loan program such as income based repayment should you fall on hard times but it does make sense for some people.

If you can get a lower interest rate on your loans, you can put more money towards savings each month.

I paid a 6.8% interest rate on my student loans and wish I had looked into refinancing sooner. I might have qualified for a lower interest rate, which would have saved me thousands.

Remember why you’re saving in the first place

I was in massive debt two years ago and now I’m aggressively saving as much as I can.

I hated living paycheck to paycheck and feeling like I was never going to get out of the hole.

I’m saving all of this money now so that I can give my family a good future and so that I can eliminate my stress.

I used to get SUPER stressed out about money and I never want to feel that stress again.

Related: From $60k in Debt to $200k Net Worth in One Year

Related: 28 Simple Ways to Improve Your Finances This Year

How do you save more money faster? Are you contributing to any savings or retirement accounts not mentioned here?

- How to Make a Backyard Movie Theater with a projector screen - September 19, 2020

- HONEST Passive Income Planner Girl by Michelle Rohr course review - May 25, 2020

- 35 Pink Aesthetic Wallpapers with Quotes and Collages - May 20, 2020

Yep, all god vehicles to save money. Congrats. You will definitely find Petsonal Capital both powerful and addictive. On the latter point, of course make sure not to react to the swings of Mr. Market when he has a bad hair day!! Keep investing through up and down swings and you’ll be well on track.

Thanks! Yes, it’s so addicting watching the net worth graph go up and down! It was hard for me to look at it when I was in major debt but now I like looking at it more! 🙂

I love how detailed and content-packed your posts are!

“You can then use the money on whatever you want!” So you can withdraw from your HSA and spend it on anything? Is this once you reach retirement age? I honestly haven’t opened up an HSA though I probably should after reading all these benefits.

Thank you! So let’s say in 2016 you go to the dermatologist and you are billed $300. Most people would expect you to use your HSA to pay the bill now. What you could do though is pay the bill from your regular bank account now and save the bill somewhere on your computer. In 2030 or whenever, you can show the receipt and withdraw the full $300 from your HSA. By that time, your HSA has grown exponentially because you never paid taxes on the money going in, you let the money sit tax free in investments and the earnings on them compound, and then you don’t get taxed when you’re pulling the $300 out, because the money was for a qualified medical expense back in 2016. Does that make sense? Check out the Mad Fientist’s post I linked to above because he explains HSAs the best.

Reimbursing yourself for qualified medical expenses makes sense. The toughest thing for me would be in keeping those receipts for so many years or decades! The part I was wondering about was for distributions on non-qualified expenses. Did a little research and it looks like there’s a 20% penalty on HSA distributions for non-qualified expenses in addition to paying income tax on the withdrawal. However, after reaching age 65, any HSA distribution for a non-qualified expense is only subject to income tax. So the HSA acts just like a traditional IRA on non-medical qualified expenses after age 65. Thanks again for writing this post. I’ve always heard about HSA’s, but truthfully never bothered to really understand them till now 😉

Ah yeah – thanks for that extra tip on the non-qualified expenses!

Ugh I wish I could add after tax money to my 401k. I could contribute to my Roth 401k but then I’d have to dial down my pre-tax contributions. No thanks!

Btw….. Sangria is pretty darn good 🙂

Sangria on the boat!!

Very sound advice all-around, Julie. That’s a pretty nice savings rate over 7 months! Your breakdown of different options is right on target, as well. Nice post!

Thank you and glad you liked the breakdown!

I had no idea that you could contribute more than the 18k max depending on the plan. I don’t think I can max out my 401k this year because I started my job mid-year but I’m going to look into contributing more towards my 401k. The thing that I’m scared about is the tax risk that comes out of investing in 401k at the age of 59.5 but I guess I’ll cross that bridge when I come to it!

I also like the list, I’m looking to increase my income and mystery shopping isn’t particularly big where I live. I’m going to look into Fiverr and freelance writing!

The tax risk that comes out of investing? What do you mean? If you mean what I think – Do you read the Mad Fientist or Go Curry Cracker? Check out the Roth IRA Conversation Ladder. That strategy is used to access your 401k prior to normal retirement age (you have to roll it over into an IRA and then Roth IRA).

True but now they are taking 10 percent or more from the ira for the people that does not work can have money to retire on . Don’t think its right for us working people. But nothing we can do.

That is an awesome accomplishment! It’s amazing how stashing a little bit here and there and it really adds up. Even though we are taking a full year off of work, as a mini early retirement, we still managed to save a bit of cash. I had committed to not investing this year, but I might end up breaking my own rule to add some of that cash to our Roth IRA’s. =)

Ooh mini early retirement – I like the sound of that! Also, congrats on saving some of the cash! That’s impressive!

The big win here is that your 401k after tax money can be rolled over into a Roth IRA upon quitting your job. By using this trick, Investors don’t need to be held to the $5,500 annual IRA investment rule.

Yup! Super exciting! Love that I can contribute to a Roth still.

Good stuff, my company doesn’t match 401k contributions but I got them to add Vanguard options a couple months ago! I’ll be maxed out this month and focus solely on after-tax. Yay for saving money!

Hell yeah! Who says you can’t save in the Bay!

I don’t know where to begin. Julie, you’re a freakin’ financial rock star. Awesome job. I’ll just comment on the HSA. This is the greatest saving vehicle known to man. Triple tax free! Money goes in tax free, accumulates interest tax free, and is withdrawn tax free. I started my HSA less than three years ago and I have nearly $11K in it. Imagine if I could have contributed to it for ten or twenty years. So if one is relatively healthy, and has access to an HSA, one would be foolish not to take advantage of it. Thanks again, Julie, for this awesome post. I’m definitely sending the link to my saving-challenged nephew.

Thanks for the kind words and for sharing the post! Love your and your wife’s story as well! You guys are living the life. 🙂

Great job, but a couple of strategy questions. I’m confused as to why you contribute after-tax dollars to your 401k as opposed to a taxable brokerage account? Are your plan options exceptionally good? Just curious as to why you would make it harder to access money for business opportunities.

Also, curious on your decision to go with Betterment. Their funds are no better than Vanguard’s, it’s simple to do the tax-loss harvesting yourself, and they may be unable to do it for you unless they manage your 401k also. In this experiment Vanguard came out ahead: http://www.mrmoneymustache.com/?s=betterment.

Thanks! Love the site!

Thanks!

Why I contribute after-tax: http://www.madfientist.com/after-tax-contributions/

The opposing argument that brokerage is better: http://www.gocurrycracker.com/roth-sucks/

Vanguard has my IRA contribution. Re: Betterment, I’m not sure everyone agrees it’s simple to do the tax-loss harvesting yourself and that is not the primary reason I use them. It was really easy to get my money into Betterment, they have great customer service (and immediate which is key for me), and I wanted to try a robo-advisor especially one with low fees. I hope to get to the threshold ASAP which drops the fees significantly. Hope that helped! BTW – I’m an MMM reader too. Great, life changing stuff.

What you don’t say anything about is your monthly income or your employer in this post — so don’t go touting your monthly savings without giving us the full picture. Be honest. How much do you make and what are your other expenses? I would like to know that. This isn’t the “anyone can do this plan.” This is the I work in corporate america and make bank plan.

True story. Completely agree. My other posts tell exactly how I got the well-paying job which I used to pay off debt aggressively and save! There was a strategy to it and I believe it’s a repeatable strategy for anyone willing to do what it takes to climb the corporate ladder.

Sounds like you’ve done a lot of research and really utilized your findings to your advantage! That amount of savings in 7 months is quite the feat for nearly anyone, so congrats on that!

It does seem like there are better ways you could have split your savings amongst the different vehicles in order to maximize your tax savings not only now but in the future as well, when you’re in higher tax brackets (of course under the assumption that your income and assets increase rather than decrease over time).

Well, thank you!

This is a great resource, and your links are so helpful!

My biggest problem is that even doing surveys and doing extra jobs, I still don’t make enough to save much… But then, once I look at how much of my money goes to Bubble Tea… well, you get the point. I shall try, though!

Your bubble tea is my ice cream. Daily habits add up! (And yes I eat ice cream almost every day. Guilty!)

These are great tips. I’m a huge fan of selling stuff you’re not using. True story – I once sold a package of frozen baked potatoes on a Facebook yardsale site. I was cleaning out the freezer and they had come with an Omaha Steaks gift box someone sent us; my husband won’t eat them and I wasn’t going to eat them by myself, so I listed them on the yardsale site and sold them for like $10!

Hey Julie!

I just loved the 24 hour rule practice.

Thanks for sharing the amazing tips! And yes, I really appreciate the way you have made yourself debt free. Happy blogging!

A great list of how to save money. I want to do list 11, Do a 24 hr practice. If I go to malls and see something I like I would grab it. Hopefully, it will help me to save money.