We crossed the $200k net worth mark this year.

It’s hard to imagine that we’ve come that far in such a short time.

Just two years ago we had $89,000 worth of debt, a massive mortgage, a car payment, and credit card bills.

We even started 2016 with nearly $60,000 of that debt remaining.

Yet, we’re ending the year with a $219,000 net worth according to Personal Capital!

Note: This net worth number includes the equity in our home (which we know is fickle but chose to include). It does not include the value of our car. It also does not include the $6,000 I have put into the employee stock purchase plan at work. I will sell the stock when I am able to in 2017 and will include it then.

-> If you want to see what your net worth is, check out Personal Capital which is free to use.

I am amazed to see that number.

2016 was a CRAZY YEAR for us personally, as well as professionally.

Here are the personal, professional, and financial highlights that led to 2016 being a banner year for us.

We Paid Off My Student Loans

I started off 2016 with a small amount of student loan debt.

I was keeping my little over $1,000 of student loan debt since I thought it would help my credit score. It was my oldest account.

I then realized that a credit score was nothing more than a tool to get more debt. Thanks to Jeremy (Go Curry Cracker) for that realization.

I made the final payment towards my loans in late Spring.

We Paid Off My Husband’s Student Loans

My husband still had just over $36,000 left of debt from his undergrad when we started the year.

He was lucky enough to work part-time for his school while getting his Masters and thus only had undergraduate debt.

I had just paid off my student loans and then I paid off my husband’s student loans less than 30 days after mine.

Once he put a ring on it, I felt comfortable paying off his student loans.

I Took a New Job

I loved my boss and the team I managed, but I ultimately made the hard decision to leave my job.

I Sold My SUV

I had been reading about this whole one-car-thing on the internet and decided to give it a try.

After 2 years of having a 90 mile round-trip commute, I was ready to get rid of the car.

I gave the car a professional cleaning, painted over some scrapes, and wiped down the hubcaps to prepare the car for sale.

My SUV had depreciated like woah since I bought it but I cut my losses and sold it to a dealer.

I now walk and take a shuttle to work (15-minute commutes are the best!)

We Moved to the West Coast and Downsized

We left the Rocky Mountains behind and moved to the West Coast.

It was really hard to leave the friends we had made over the past 5 years, our beautiful home, and our lifestyle.

The West Coast is way more expensive, faster-paced, and less chill than where we had previously lived.

In good news, I sold $4,500 worth of our stuff on Craigslist when we downsized.

We now rent out our house and someone else pays our mortgage.

We Kicked Our Savings into High Gear

One of the reasons we were able to achieve a $200k net worth after paying off all this debt is because we had been saving for a few years prior.

While we never maxed out our tax-advantaged accounts, we did put away some pretty pennies in 2014 and 2015.

Yes, we still had massive debt at that time but we saved anyways.

Some would call that a mistake. I don’t know what I would call it but it made it pretty nice to start from a non-zero number once we were debt-free.

We now save for retirement the boring way by socking away money in our 401(k)s, IRAs, HSAs, ESPP, Brokerage accounts, Betterment Account, etc.

Life is good.

I Finished My Masters Degree

I have been chipping away at this degree since 2014 and I am so excited to announce that I am done!

I wrapped up my last final two weeks ago.

Check out this post on how I hacked my graduate degree.

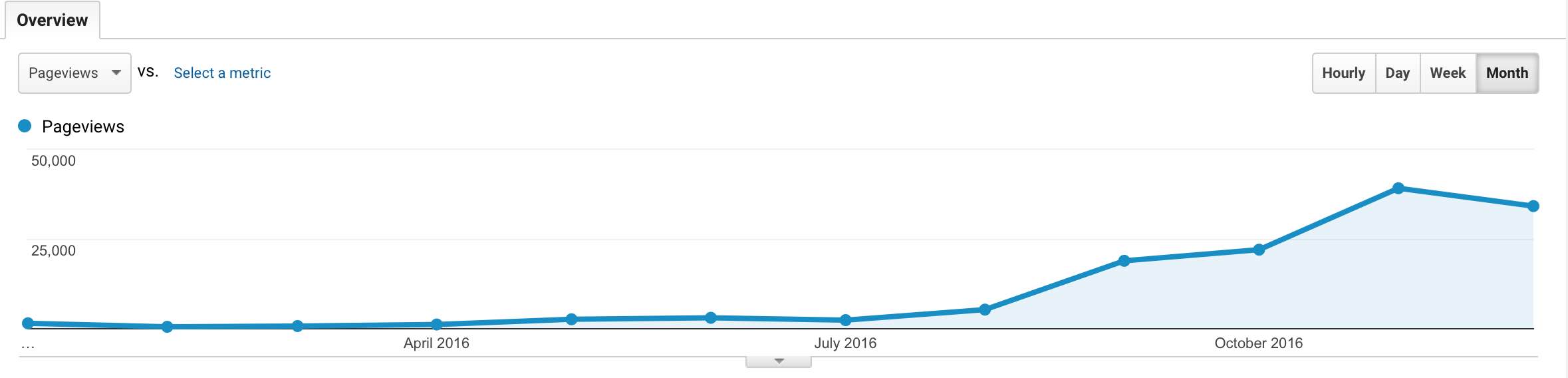

I Grew My Blog

I started this blog in 2015 to track my debt pay-off and it’s grown tremendously.

I received nearly 40,000 page views last month which still blows my mind.

My goal is to get to 100,000 page views a month in 2017.

I truly believe that I held myself accountable to both my savings and debt goals because of this blog.

Posting about my progress every week has given me the kick in the butt I need.

At first I was afraid to blog because I didn’t think I had anything else to add. I decided to just go for it though and I am so happy I did.

I also met some amazing people through this blog both online and in real life.

I’m also making money on the blog now. I’m up to a few thousand dollars in passive income per month.

-> If you’re interested in starting a blog, I wrote a tutorial that might help you – How to Start Your Own Blog.

We Got Married!

Most importantly, I married my best friend in 2017.

In true millennial fashion, we had a Harry Potter/ Game of Thrones wedding and it was AWESOME.

I wrote a Frugal Wedding Series for the blog and most recently wrote about how we did our own wedding flowers. I think they came out pretty good for DIY!

It was such a great night!

I’m so excited for what 2017 has in store for us!

How did you do in 2016? What are your goals for 2017?

- How to Make a Backyard Movie Theater with a projector screen - September 19, 2020

- HONEST Passive Income Planner Girl by Michelle Rohr course review - May 25, 2020

- 35 Pink Aesthetic Wallpapers with Quotes and Collages - May 20, 2020

This is so inspiring! 2016 seemed to be a great year for you, and 2017 will be even greater.

Thanks so much! Happy new year and good luck next year!

Congratulations Julie! You are such a BOSS!

What a great year and so much more to come in 2017.

Thank you!! So are you! Happy new year!

Awesome year, Julie!

I’m glad you’re still writing about your personal experience, you had mentioned wanting to distance your blog from that narrative. What you have achieved in such a short time is amazing. Hope 2017 is as amazing as 2016 was.

and congrats on the marriage, i feel like that’s the biggest FIRE variable of them all – who the hell are we going to end up with and will they tolerate this crazy life choice?

Yup I guess the blog is instead getting more personal than I had intended! This is my most personal post (numbers-wise) to date. Thank you for the congratulations on the marriage. Totally agree that your partner is the #1 FIRE variable. I lucked out to have a partner totally on board!

Nicely done, Julie! You guys totally crushed it this year. I’m not anticipating a huge net worth jump in 2017. I’m more focused on finishing my CFP classes than increasing my income. But once I pass the exam, I’ll be back at it. Keep up the amazing work!

Thanks, Kate! Good luck with the CFP exam!

Great work paying off all that student loan debt and all of your other accomplishments in 2016! You’re making me feel like a slouch… 🙂

Haha not a slouch at all. Thanks for the kudos and happy new year!

Sounds like you crushed 2016!

Congrats on your recent marriage…it was great getting the opportunity to meet your and our husband in person at Fincon.

Looking forward to follow your continued financial and professional domination in 2017 and beyond.

Happy New Year!!!

It was great meeting you too! Good luck with your goals in 2017. I am totally going to copy your idea to count the total # of days you work out. I can see that motivating me. Happy new year!

Congratulations on your wedding and on a financially kick-ass 2016. May your 2017 put your 2016 to shame!

Thank you! Same to you!

You are such an inspiration! I am so happy you shared your story because it gives me hope that I can accomplish my dreams one day as well. You’ve accomplished so much in so little time, it’s amazing! Congrats on your marriage by the way. I hope this new year is even better than the last. Thank you for inspiring me and so many others. It makes the idea of being able to graduate college with little to no debt seem not so crazy.

You got this! Thanks for the kind words and happy new year!

Congratulations that’s an awesome achievement! I get you about the blog holding you accountable. I don’t think I’d have had anywhere near as much success last year with saving money without my own blog to keep me on track. Wishing you much success for 2017, here’s to financial independence!!

It’s crazy how motivating blogging can be. Happy new year!

Wow! Work guys, this is absolutely amazing and I cannot wait to read more about your story. One of the most important things is beating out that student debt and you guys did exactly that. I am also a Millennial blogger who talks about financial education for young adults because it is so important. I’ll be back for more 🙂 -> The Mindful Rise (www.themindfulrise.com)

Thank you for the kind words. Good luck with your 2017 goals and finances!

Wow, that is so awesome. Congrats. What a great year, and what a great way to start 2017. I want to be like you when I grow up.

haha am I that old?! thanks!

How you’ve been able to increase your salary and pay off giant debt is really inspiring. Keep up the steady and awesome work! I’m also about to pay off my student loans. On track to finish them off this year, then I will be debt free!

Thank you! Much appreciated!! Hope you have a great year!

You’re going to knock them out this year I can feel it!! Good work and hope 2017 brings great things for you!

Loved reading about your story. Very inspiring. Congrats on your marriage:) Will bookmark your website to follow your progress and journey!

Thank you! Much appreciated.

Is the $200k net worth combined net worth of u & the new husband? or just yourself?

Both but does it really matter?