If you’re coming from Rockstar Finance, welcome! Today’s guest post on Millennial Boss is from The Happy Philosopher.

I first heard The Happy Philosopher on the Mad Fientist podcast, where he talked about finding happiness along the path to FIRE. This is a topic that I discuss frequently with guests on FIRE Drill, my podcast about financial independence, since so many of us struggle with burnout and staying content on the demanding path to FI.

I asked The Happy Philosopher to expand upon that subject in today’s post. Enjoy.

I have a confession to make. I’m not a millennial. And due to the laws of space and time I will never be one. As a formerly burned out gen-Xer physician, you may find it odd that here I am writing a guest article on Millennial Boss, after all I had to google the term ‘woo girl’ when I read this post, but there is a method to the madness.

You see, oddly enough millennials are my largest demographic of readers. I don’t know why this is exactly, but in my mind I imagine it is because I am just a step or two ahead of them on their journey. My purpose here is to step on the financial land mines and report back to you (if I survive).

If you are reading this, you are probably on the path to increasing your degree of financial freedom. Maybe you are in the phase of paying off debt, or building an emergency fund, or have a small pile of FU money. What happens next though? Maybe some of you have noticed that as the journey progresses, the experience changes.

The Journey to Financial Freedom

At first, you discover this weird place on the internet where people are actually living debt free and saving money. Some are even retiring early and achieving financial independence at ages you thought unimaginable. You dive in head first, reading blogs and books, aggressively throwing money at debt and savings.

Life is awesome. You are excited for a year or two.

Then something changes.

You are not sure what it is, but suddenly it’s hard to stay motivated to keep saving in this weird place between financial security and financial independence. You can’t quite put your finger on it, but you start to second guess yourself. Funding the Roth IRA brings us about the same amount of pleasure as scrubbing the toilets week after week, and frankly you wonder if it is all worth it.

I’ve noticed this too, and upon reflection I think this is related to a concept that you may already know.

Hedonic Adaption

This is commonly known as the hedonic treadmill which according to Wikipedia is:

“The observed tendency of humans to quickly return to a relatively stable level of happiness despite major positive or negative events or life changes”

We spend more money to get something a little better, and indeed it makes us a little happier. Unfortunately that feeling soon wears off though, and we are right back where we started.

Rinse.

Repeat.

There is no end to this cycle as our spending increases to fill this unfillable void.

This is FIRE 101, and we all know about it. There is a post about it on any self-respecting financial independence blog (Note to self: write post about hedonic adaption). We also know that we need to interrupt this process if we ever want to become financially independent.

What is sort of non-intuitive though is this also works for saving money, though slightly different. Let me give you an example.

The Psychology of Saving

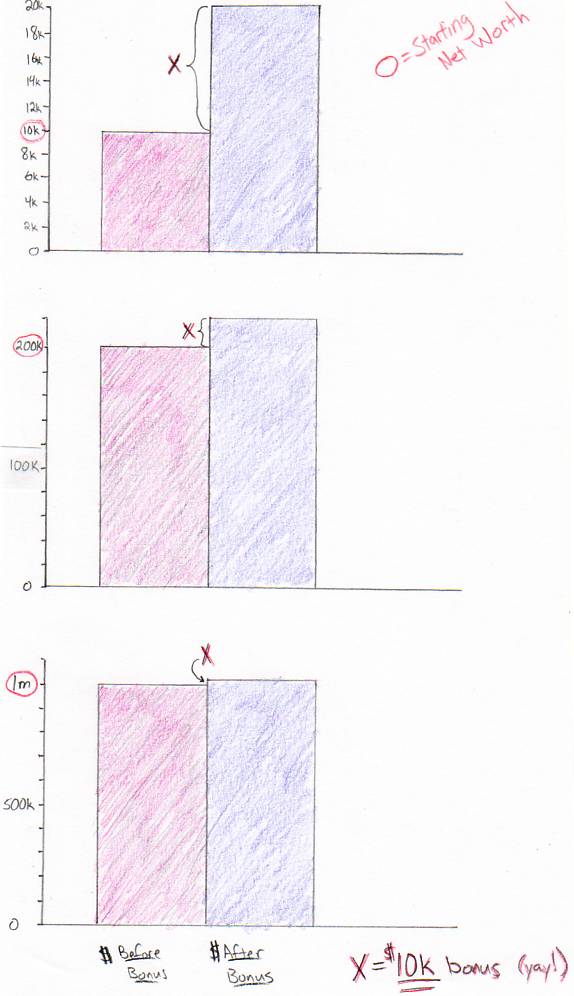

Pretend you have a pile of money, let’s say 10k. You did something super impressive at work and your boss gives you a 10k bonus. We just increased our net worth by 100%.

BOOM! There is a big hit of neurotransmitters turning on all the pleasure and happiness centers in the brain. We run around the house screaming, nearly giving the cat a heart attack as she tries to figure out what is happening.

Life goes on. You plug away at work and life. Eventually that pile is 200k.

You get that next 10k bonus and make the deposit, but it doesn’t have the same feeling as that first time. It doesn’t move the needle as much; after all it’s only a 5% increase.

The psychological effect is less, and by this point you have built up a tolerance to the feeling of happiness you get by saving. The newness has worn off. If you think of this as a marathon, those middle miles are not as exciting as the start when the adrenaline is pumping and everyone is cheering.

The cat is happier though.

As time goes on things get worse though. When you get to a million (which is probably close to FI for many if you use the 4% rule as a proxy) that 10k is only a 1% change in net worth. It is almost imperceptible. In actuality your portfolio can easily change by more than this in a day just due to market fluctuations.

And yes, your cat is laughing at you.

Another example: Let’s say you save up enough money to be able to quit your job for 2 months.

This may feel amazing to you if you just emerged from debt. It may be the first time in your life you have experienced freedom like this.

It probably feels amazing.

But if you already have enough money to stop working for 4 years…well increasing that to 4 years 2 months doesn’t really feel any different.

Related Posts:

- The Secret FIRE Cult and Why You’ll Want to Join It

- Why Wait Until You’re Financially Independent to Live Like It?

Why This Matters

You may lose motivation. As a species we crave positive feedback, and avoid negative feedback. This is a survival mechanism.

Once we lose that good feeling we get from saving money, we are tempted to use it on something that does feel good. In other words, when buying that new pair of shoes feels 10x better than saving for financial freedom, we may suddenly find ourselves with a closet full of shoes we don’t wear at the end of a particularly stressful month.

My point is it is hard for most people to really stay motivated, and if you stumble and fall you are not a bad person. You are simply human. This is normal.

The concepts of personal finance are simple and easy. It is the psychology and human behavior side of things that is hard. I’ve seen people stumble on the path to financial freedom, and I think hedonic adaptation to saving is a big part. If you want to avoid this it is mandatory to put systems in place that manage this risk.

Automate and Forget

The best single tactical way to do this is simply to automate the savings.

Do not make it a choice.

Take the possibility of doing something contrary to your goals out of the equation.

I know this sounds simple enough, maybe even too simple, but it is effective. Put a percentage of your income into your savings and retirement accounts and then forget about it. Let the magic of the capital markets, or real estate income, or whatever you invest in compound over time.

The less often you look at the overall numbers, the bigger the changes you will see, and probably the more motivated you will remain.

- Automate savings

- Go worry about other more important things

I know what you are thinking. This idiot spent a thousand words telling to pay myself first? This is like the most basic financial concept ever. I already know this. And that’s the dumbest bullet point list on the internet.

Fair enough. Let’s move on to a more difficult problem then.

When Motivation Dies

Where do you find that motivation to keep going when you hate your job, or are completely burned out? When I was in the maximum zone of burnout, my paychecks were at their largest. It felt empty though. Dumping piles of money on an even larger pile of money became an abstraction. They were just numbers on a spreadsheet with no meaningful impact on my life in the immediate present.

Maybe you feel like this right now. I understand the pain and emptiness that goes along with this, and if you are burnt out my advice will seem hollow. The right answer will vary from person to person:

- mini-retirement

- career or job change

- recalibration of other parts of life outside of work

The wrong answer is pretty consistent though; giving up on the journey to financial freedom. It is so easy to get discouraged and want to give up. I have been there. Remember, there is a future ‘you’ who has to live with the consequences of your actions now. You can try and outrun the treadmill, spend your money today; stop saving and go back into debt, but it will probably not bring lasting happiness.

Related Posts:

The Big Picture

The more important question though, and something that is much harder to answer in a couple thousand word blog post, is why are you seeking financial freedom in the first place? There has to be a why, because financial freedom is not a goal in and of itself. This is why it feels empty at times. This is why the excitement and enthusiasm wanes.

“Financial freedom simply creates the space for something else. If there is no something else the freedom doesn’t matter”

I encourage you to keep wandering down the path of financial independence. It truly is a great way to live life, but it is not everything. Financial freedom is just a means to an end – the end being happiness and contentment.

This is where the real work begins. When I came to this revelation it shifted my thinking from being happy later (when I was financially free) to being happy now. If you cultivate happiness, freedom is the byproduct.

Instead of dwelling on the spreadsheets and trying to push your savings rate from 43 to 43.7% (which will not make you and happier now) try these things instead:

- Start meditating 10 minutes a day (or 5 or 1, whatever works for you)

- Start a gratitude journal for 5 minutes a day

- Write your goals on a piece of paper and put it away. Come back to it in 6 months and be amazed at how much progress you made.

- Examine your relationship with food and alcohol and start experimenting

- Start getting rid of clutter

- Practice saying no to obligations that negatively impact your life

- Stop watching news

- Get into nature more often

- Compliment someone

I could go on, but the point is take action. Start making small changes in your life to be happy now. If you are on the path to financial freedom, don’t dwell on the details too much. This mental model helped keep me on the path because it took the focus off the financial side of things. Financial freedom is not meaningful if you are not happy, and I know plenty of financially free people that are miserable. Happiness is entirely possible without financial freedom though, and this is the place you want to be.

Bio: The Happy Philosopher is a father, husband, and physician who occasionally downloads his thoughts onto the internet at thehappyphilosopher.com. Although he thinks social media is mostly evil and unnecessary clutter, you can follow him on Twitter and Facebook and he will not judge you.

From Millennial Boss: If you liked this post, check out more posts on Millennial Boss and definitely check out FIRE Drill podcast. I co-host the podcast with the amazing Gwen from Fiery Millennials and we have 41 information-packed episodes about financial independence and creative side hustles. Our most recent episode was about building hobbit houses for passive income! We crossed 100,000 downloads in January and were nominated for “Best New Personal Finance Podcast at FinCon” this Fall.

- FIRE Drill is on iTunes and Google Play.

THANK YOU!

- How to Make a Backyard Movie Theater with a projector screen - September 19, 2020

- HONEST Passive Income Planner Girl by Michelle Rohr course review - May 25, 2020

- 35 Pink Aesthetic Wallpapers with Quotes and Collages - May 20, 2020

I enjoyed this post a lot. It’s so true that happiness is far more important than money! A lot of people tend to forget that on their journey.

Thank you for publishing this guest post. The Happy Philosopher is dead-on that we all need something else to fill that void, Financial Freedom isn’t the means to and end but not the end. We all have to understand our Why

Man. I don’t know what the alternative is. If you give up, you’re basically saying it’s okay to burn-out over a lifetime of cubicle BS. Good tips at the end regardless of whether you plan to retire early. For my money, I’m finding it harder and harder to feel burned out knowing I have a finite amount of time before I can move on to other pursuits.

Someone finally put my feelings into words! Debt fatigue and burnout have been my reality the past few months. Nice to know I am not alone.

Just keep going. Future you will thank you for the effort.

My path to FI has been a little different than you lay out above. I crushed my student loans in 3.5 years on a low salary, but then I just floated for a few years. Wish I had taken this advice and automated my savings once there wasn’t debt to put them to.

This is the most important, and hardest part at the same time. You have to constantly keep reminding yourself of why.

But, if you aren’t happy with your life now, you need to figure out what makes you happy now, because once you’re done. You’re not going to automatically be happy.

As always, HP comes out with another killer post! When you are happy and seeing a difference it is so easy to just keep meandering down the path to financial success. But when life starts to suck, all the negativity seems to come out of the woodworks, utterly overwhelming you and it seems impossible to even take one more step forward. I love your advice to just take action. If you don’t do anything, you will end up back on the hamster wheel, spinning around and around without a goal.

Thanks Happy Philosopher! As someone who is new to the FIRE concept it is great to hear what the process will be like in the years to come. I love how you include info on both the why and the process necessary to reach financial independence. Both are very important.

Thanks for the encouragement!!! My FI goals are completely anonymous so I have to find intrinsic motivation, which can be challenging.

It’s a good time to reassess what makes me happy and do more of that, rather than pushing joy off to when I am financially independent.

Great post! We are still in the stage where pushing the “buy” button on Vanguard each month gives us a major thrill but I can see the potential pitfall down the line. Awesome advice. Thank you!

Such a great post and so true. Becoming FI, or retiring is only as great as it allows you to focus on something else. Problems before fI are still problems after.

Great guest post. As a Gen-Xer who has been on the road to FI for a long time, I can relate to feeling burn-out from time to time. The idea of automating your savings/investing takes most of the thought out of it. For most people, reaching FI takes a long time. It can be overwhelming thinking about having to save 25 years of living expenses. As the Dr. wrote, don’t think about it. Try to practice meditation to make the day more enjoyable. I find that trying to help other people along the way makes work a bit more tolerable. If FI is your goal, don’t give up. Every deposit into your 401K is a step closer to your goal.

Automate and forget about it. FI is a long term goal. You can’t worry about it on a day to day basis. You have to find the joy in everyday life. If you’re miserable for 10 years while you’re chasing FI, you’ll probably be miserable after FI. Good luck!

I’ve only been on the hardcore FI track for about a year now. Before that I was just trying to be as financially savvy as possible with no real clear goal.

The biggest reason I’m pursuing FI right now is for my future family. I want to be able to be with and take care of my wife & our unborn son as much as possible.

Thank you for sharing this!

The first question I ever asked myself when I started my blog 3 weeks ago was “How in the h*** am I going to write about a topic that can be so boring, and turn it into something people will want to read consistently read?” I asked that question to myself because although I have only been really into my personal finances for about 2 1/2 years, the burnout feeling even hits me at times. You makes great points that staying physically active is a good way to prevent this by taking your mind off it, and letting your batteries recharge.

Thank God though that funding those Vanguard Roth IRA’s is still one of my favorite activities!

Great post!

Damn it, HP, you’re all over the place. And I love it. Don’t know what I can add to your excellent post. I never experienced FI burn out. And I think that is mostly due to luck. I never really yearned for material things beyond the basics, and I never needed much to make me happy. I get tremendous Chris Matthews Leg Tingles just putting spare change into a coin jar. How do you get people to recognize and relish “enough” on the material front? And how do you get people to appreciate mundane nicities on the spiritual front? I haven’t a clue. Other than that I’m a freaking’ genius. Thanks for the great read. Cheers.

Hahaha! Thanks Mr Groovy!

In regards to your questions I think the old saying “when the student is ready the teacher will appear” applies here. Enough is a concept people have to back into and come to on their own terms. I write this kind of stuff knowing that most won’t be ready for it, but when it hits the right person it could change their life.

I laughed out loud about the cat. Thank you!

Thank you everyone for the comments and kind words, they mean a lot to me.

Also a big thanks to Millennial Boss for letting me share my writing her awesome readers.

🙂

Such wisdom, as always. It is tough to follow all of it always, but any effort is better than none. I love the sense of perspective and what is really important in life. I find myself grumbling over minor inconveniences at times and have to bring myself back to the beauty of the present moment. A regular meditation practice helps with that one.

“Financial freedom is not meaningful if you are not happy, and I know plenty of financially free people that are miserable.”

Such a powerful statement! We Must remain cognizant of the fact that happiness is not contingent upon being financially free. Be happy today while walking towards financial freedom.

I think this entire post should be on a billboard somewhere and people should be forced to read it as they drive/walk by. I’ve been on this FI journey for about a year or so and the words from this post hit me in the gut so hard it felt like it was written for me. So hard to stay motivated, I’ve found myself in a cycle of debt pay down/saving/ debt pay down/ big chunk of debt pay down/ save some more. Trying to find new articles to read to keep me motivated has been challenging but every now and then one of these pops up and it’s a nice gut check. Appreciate it!