I wrote recently that we paid off $89,000 of debt and now we’re a debt free couple. Turns out that I was a bit premature in that announcement.

I had a conversation with my parents that reminded me that they still have Parent Plus loans from my education.

Parent Plus loans are loans that parents can take out to help their children pay for their education.

Like student loans, Parent Plus loans are becoming a national problem too.

From 2005 to 2015, the number of parents taking out Parent Plus loans rose from 700,000 to 2.2M.

Parents Taking on Debt for Their Kids

It was taboo to talk about finances growing up in my family.

I wish I could have had an open and honest conversation with my parents about how we were going to pay for my education before I entered college or even during college but we never did. I didn’t have the maturity to know any better.

My parents were so proud that I got into a great school and they think that all the debt they are in now was worth it and necessary.

My parents told me today that they owe $50,000 for my sister’s and my education combined and that the interest rate on those loans is 9%. Wowza.

Here I am planning early retirement and thinking I am “done with my debt” when my parents are struggling with my student loans still.

I have to help them.

One option I looked into was refinancing that debt into my name.

If you have your own student loans or you have a parent who has Parent Plus loans and you want to refinance (get a lower interest rate) allowing you to save money over the length of the loan – consider refinancing.

I’ve considered using SoFi to refinance my parent’s loans into my name. I found out about it too late for my own debt and had paid a 6.8% interest rate until I paid them off. I should have refinanced and saved thousands.

My fiancé also still owes his parents thousands of dollars for a car that they purchased for him five years ago. His parents have nicely dropped what he owes to just the Kelley Blue Book value but it’s still debt that he owes.

I think baby boomer parents taking out car loans for their millennial children is quite common too.

Who is Responsible for Paying this Debt

The Baby Boomer generation probably shouldn’t have helped Millennials take on car loans and education loans by cosigning on those loans. They probably shouldn’t have stretched themselves thin by taking out parent plus loans and lines of credit against their home equity. They didn’t know any better though and either did millennials.

They were part of a generation that felt they should give everything to their kids and they had access to all different types of credit to do so!

So we have two choices here. My fiancé and I can be millennial stereotypes and mooch off our parents some more. We can let them continue to carry our debt well into their retirement years. We can complain about it and point blame at them or the government.

Or, we can do the right thing and take over all of our loans from our parents and start paying our fair share. Yes, it sucks because we didn’t really know what was going on when we took on the debt but we still did it and we are responsible for it.

We can’t be alone.

The Illusion of Saving Money Living at Home

Millennials have their blinders on when it comes to their parents. It’s not rare to find a millennial who believes that they’re saving money by living at home, staying on the family plan, or staying on their parent’s health insurance until they’re 26.

They’re not saving money. Someone is paying for their food, housing, and utilities even if they’re not.

Maybe if millennials look a little closer into it, they will see that many of their parents aren’t actually paying for any of this at all. It’s an illusion of security. It’s debt that’s carrying them and their parents through.

If you think your parents are helping you out by paying your student loans or your cell phone bill, ask yourself (or better ask them), are they really?

It’s possible that your cell phone, insurance, and even education were paid with debt dollars.

Or it’s possible that the money your parents are paying towards your housing and education should really go towards their retirement.

Interesting Debt Trends

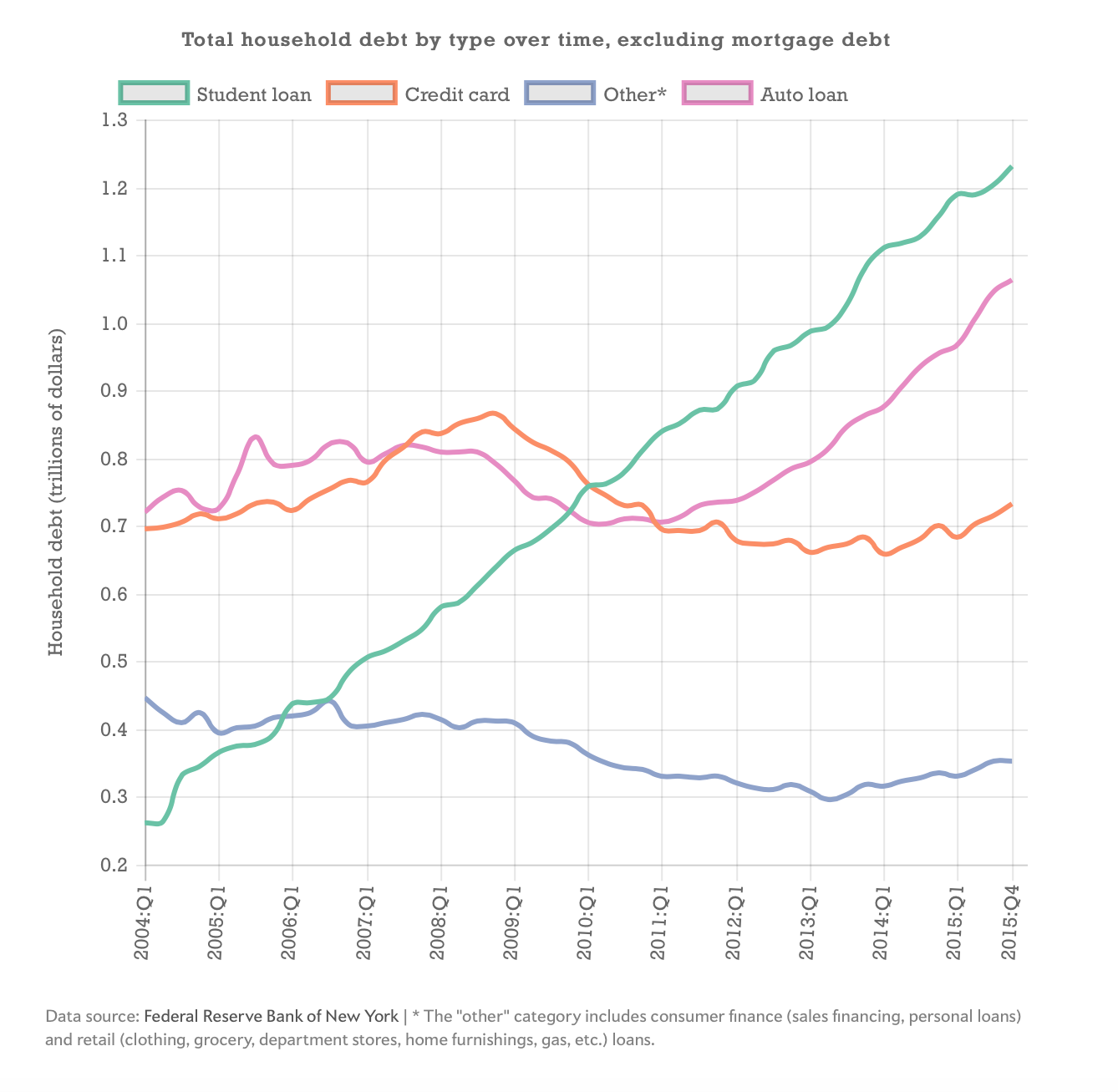

Check out this Slate article about the trillions of dollars that American families owe in non-mortgage consumer loans. I think it’s interesting to see the rise in auto loans and student loans in the past few years relative to other forms of non-mortgage consumer debt.

Can anyone else relate? Do you have debt that has come back to haunt you?

2017 Update: I’ve since paid off the $6,900 of debt that my parents still held for my education. We found out that $43,000 of the debt was for my sister’s education. I decided to hold on refinancing the debt into my name for now and plan to help them out at a later point.

- How to Make a Backyard Movie Theater with a projector screen - September 19, 2020

- HONEST Passive Income Planner Girl by Michelle Rohr course review - May 25, 2020

- 35 Pink Aesthetic Wallpapers with Quotes and Collages - May 20, 2020

I thought I left a comment here, but maybe it didn’t get posted?

My main point was to say that I’m not so sure you need to take care of your parents first, particularly if they’re not asking for the money. Sounds like you have a good relationship with both sets of parents, so isn’t it better to make sure you’ve maxed out retirement accounts first before helping them? After all, one day you may be taking care of them so your own stability is important to them too!

Oh no your first comment didn’t go through! Yeah it’s such a tough call. I go back and forth. Luckily I did front load my 401k and contribute the max to my IRA but my fiancé hasn’t and we’re planning on doing his by year end. Our parents are older though so we want to help them as soon as we can. Otherwise they can’t retire. My dad is already 65.

My teacher in high school said it is nice to take care of your parents but do not put yourself under financial burden. You are your fiancé are much younger and it would make you feel awful to make your parents prolong their retirement. On a personal level I think you are doing the right thing as you have a lot of recovery time compared to your parents. Yes you will likely need to take care of them in the future but it will give you and them some piece of mind that you are helping them pay off the debt. Kudos to you, life is not all numbers there are human emotions as well (good or bad)

Yeah, totally. I know my Dad grew up with 3 generations living under one roof. Culturally, we have went away from that [children’s responsibility to help out parents] in recent generations. While I don’t know if I want my parents living with me (ha!) the least I can do is help them out financially.

Wow. While not particularly worried about either my wife or my parents, this brings up an important topic that not nearly enough millennials are thinking about: the impact parent’s debt will have on us. Millennials are so focused on their own debt that it’s sometimes difficult to come to terms with the fact you very well could be taking care of your parents when they near retirement.

I have a brother who, due to a medical condition, I have already accepted that I will be funding his retirement and in general taking care of him once my parents pass (though this transition could happen much sooner than that). He has some student loans but went to a less expensive college, but has trouble finding full-time work (only 15% of people with his condition have full-time employment). It’s a tough pill to swallow but I am prepared to take on this responsibility. For me this is not a surprise, but there are many who WILL be surprised when they find out that they have some huge unexpected financial obligation on top of what they already have.

Great that you’re already preparing for future family responsibilities. You have a very mature and accepting perspective on it too. I don’t think this topic is discussed enough in the finance community. It’s all about millennial’s debt but not about preparing for the responsibility of aging parents.

Wow, that’s a lot of stress and guilt, eh? I wish when we were paying off debt we’d made retirement a bit more of a priority. (Heck, with all of our expenses we’re still not making it as big a priority as we should.) So I agree that you should definitely try to make sure your accounts are maxed out and contribute with what you have left. OF course, I’m not sure what “maxed out” means for a 401(k) but at the very least do make sure both your IRAs are fully funded.

I think it’s great that you’re owning up to the loans, but also remember that your parents willingly took it on. Also, it might be a good idea to sit them down and tell them that you want to repay the loans because you’re worried about their financial position. So maybe could all of you sit down and make a financial plan to be sure that this money helps them get out of credit card debt?

A sit down would be awesome but I don’t think it will happen anytime soon. I had the hardest time even getting them to even agree to give the loan over to me in the first place. Every time we talk about their financial position they usually respond with “well it was necessary to get you kids to where you are today.” They sent us to club sports, expensive colleges, etc. and never spent money on themselves. Totally agree it was their own doing but I also want to help them because they’re good people and thought they were doing the right thing.

This is a tricky subject, and I’m not sure how I feel about it. On one hand, I don’t think we should expect our parents to bankroll us through our twenties. But on the other, if parents take out a loan for their child without really explaining the ramifications to him, I don’t think it’s unfair for the parent to be responsible. Regardless though, I have a lot of respect for you for taking responsibility for this!

Thanks! Yeah it’s strange for sure. What drives me to take over the loan is that I know my parents debt causes them a lot of stress and I want them to be healthy as they move into this next stage of their life. More millennials are probably in this situation but don’t realize or aren’t in a financial position to help.

Ooft. I’m sorry to hear all of that, but I’m glad that you’re in a position to help out.

One of my motivating forces for getting our finances in control was watching my parents both struggle after their divorce. Neither of them had anything saved. Now, my mom’s close to retirement age, and while she doesn’t have debt outside of her mortgage, I’m not really sure what she’s going to do. Her fiance doesn’t have savings either, and we’re not really in a place to support them for the entirety of their retirement (although I hope that we’ll get to a place where helping out won’t be a financial burden for us).

We were also a family that never talked about money. That’s definitely something I do differently with my kids – there’s no shame in having a budget or understanding the expense of things, or understanding that in order to buy the things we really want, we need to make sacrifices. They’re 3 and 5 now, so it’s not like we’re having super in-depth conversations about it yet, but they do understand that we work for money, and that food and toys and school cost money, which I think is a good start.

Oh – and PS – nice new blog header!

That’s a great start! They are lucky to have you starting them off with an understanding of money and finances from day1! I didn’t change my blog header. I wonder if it is appearing differently..

Not a new image up top? Well, that’s what 2 kids and sleep deprivation will do for you 😉 (Or at least what they’ll provide a convenient excuse for…)

Haha no worries!

Yikes! I’m glad I don’t have to worry about this with my parents. They stalwortly refused to take on any debt or liability for me at all- from my first cell phone to my first car to my college education, I paid for it. My stepdad retired early after losing his job in 2009 and my mom works part time so they’re fine. I can’t imagine hearing they were in debt up to their eyeballs. Good luck with everything! Feel free to email me if you need to rant!

Wow I can imagine that made you very resourceful and independent at an early age although it was probably frustrating at times. Thanks – yeah somedays I’m like “I got this!” but other days like today I’m thinking “why/how can I carry all of these people and myself?”

The rise in student loan debt is crazy! And yes, a similar thing happened to me recently. I kinnnndddd of knew my parents took out some loans to help my pay for my graduate degree, but it wasn’t until recently they asked me to take over paying that debt (roughly $10,000). Add that to my $80k loans 😉

Good for you guys for paying off that much in loans, though! I’m slowly working through it too!

Ah! Same thing happened to you! I think our parents had the best intentions when signing up to help us out from the beginning but they weren’t realistic about their abilities to pay it.

Oh my gosh. What a great post! As I was reading it, I was thinking, “The dad should have been more clear about payback terms” with regards to the car, and “Why didn’t her parents let her know how much debt they were in?” But no one talked about money in the household I grew up in either. It’s a different story now. Our kids know exactly where we stand when it comes to money. There are no secrets. Nothing is too awkward to discuss. They (teens and twenties) are less comfortable with it than we are, but your post encourages me to to keep on with this “no financial hush-hush” attitude.

You have every reason to believe in yourselves. You will deal with these new-old debts effectively, and while they are significant, they won’t have a significant impact on your financial future. You’re setting things right – for yourselves and your families. Well done!

Thank you! Yes, I recommend keeping the financial communication lines open given my experiences. I think my parents were trying to shield me from worries and problems but it only exacerbated them!

Great post. And great point about how many options we have today to get ourselves into debt.

I think you’re doing the right thing in helping out your parents, because a part of their debt is to help you pay for your education. They certainly did it out of love for you and your sister, but they also deserve to retire and enjoy their retirement. You and your fiánce will have time to recover fast and start saving for your own retirement, if paying off your debts so quickly is any indication!

Thanks! That is how I’m feeling about it too. I’m in a position to help and I want to help them!

Haven’t really had debt thats haunted me yet, except for the occasional promise to do manual labor around the yard for my parents when I visit. They usually make me pay for that debt I owe them everytime

Haha that’s great! Gotta help out the parents!

Interesting read …. I haven’t thought about what types of debts my parents may have because of my brother and I …. nor have I thought about what my in-laws have financed for my husband and sister-in-law. If we come to a point that we are debt free and able to take care of our obligations (including retirement) we will go back and help our parents. I don’t want to see them suffer because of debt they accrued or us but at the same time if they haven’t shared it with us before now (we are later 20’s early 30’s) then is it really on us?

It’s such a strange situation, right? They got into these situations out of love for us (their kids) but yeah, it’s totally unclear what the right thing to do is. I know their debts drive me to be more successful because I want to help them! Good luck in your debt free quest! Hopefully it’s sooner for you than later!

Props to you for paying your parents back! Taking responsibility is definitely key to financial success.

Yup! Even when it stinks sometimes.

Girl, I am in that same boat right now with parent plus loans! That’s exactly why I started my website. You mentioned in your intro that you make 600% more being in tech now versus your $30k a year job. Can I just say YOU ARE AMAZING! How are you doing it though? Through coaching, ad revenue? I’d love to hear all about it!

Hey Catherine! Can’t wait to check out your blog! No, no I don’t make 100 Gs off this website but gosh, do I wish I did! That is part of my cubicle escape strategy though. I started working in an IT department of a financial services company and now I work for a technology company. I got my masters part-time while I was working for the first company and it helped me land the job at the second.

I ESPECIALLY like when you touched on the illusion of saving money whilst living at home. I truly believe it is a security blanket for many. I know I’ve tried to explain to fellows that it isn’t truly saving money for all the reasons you said before. If anything, I feel that people I know who live at home actually spend more money out and about because they don’t save any of their income, due to the illusion of saving money whilst living at home!

Thanks for sharing this real, raw post! xx Julia

ajmoneymatters.com