Cryptocurrency has been the talk of the town lately and I’m so out of the loop.

At work the other day, one of our interns was talking about the time he lost all of his Dogecoin on Christmas Eve when Dogewallet was hacked.

Apparently it was a rough Christmas for him.

If you don’t know (I didn’t), Dogecoin is a cryptocurrency that played on the popular Shibu Inu dog meme “Doge.”

Let’s pause for a second.

People are making cryptocurrency based off of dog memes and other people are buying it.

You have to be kidding me.

Clearly I’m behind the times so I asked the Twitterverse to help me write this post on cryptocurrency.

I really do want to understand it. Thank you to FIRE Millennial, Money Corgi, and George for this epic post.

Today I’m sharing Part 1 of the three-part Bitcoin Series, a guest post from Money Corgi.

- Part 1: How Hackers Stole $12k in Bitcoin From Me Overnight

- Part 2: Millennial are Buying Cryptocurrency; Here is What They’re Thinking

- Part 3: Why I Invest 20% of my Net Worth in Cryptocurrency

PS – Not invested in Bitcoin yet? Get started here with Coinbase.

Money Corgi On Why He No Longer Owns Bitcoin

I want to share my personal Bitcoin story as a cautionary tale for anyone thinking about getting involved. I dont wish to put anyone off or scare people into thinking BTC is worse than it is based on my experience. As with most things you need to do your own research and come to your own conclusions. There are many pitfalls that I’ve fallen into and want others to avoid.

I first heard about Bitcoin around 2011 on a forum dedicated to “folding”. Without getting too technical this was a way to use your computer to help perform calculations on human proteins to help Stanford University learn more about how they work. (the project is still active at http://folding.stanford.edu if you would like to learn more.)

At the time most people used it as a way to test the power of their computer and compare it to others. I downloaded the mining software and let it work, then got incredibly bored watching my computer run 24 hours a day doing not much except waste electricity.

Bitcoins are created by solving large maths problems that are set by the system.

The computer which solves each problem is given 50 Bitcoins.

Overtime the difficulty of these problems increases which means people need faster, more powerful computers to be in with a chances of being the lucky miner who gets the 50 coins.

Mining Bitcoin as Part of a Team

Even in 2011 the difficulty was so high that the best way for individuals to mine coins was to join a mining “team”.

These teams would pool together computer resources and everyone would earn a share of the 50 bitcoins that would eventually be rewarded.

I joined one of these teams and mined for a couple of weeks. I’m unsure of the exact total but I think I made about 50cents worth of bitcoins for my effort. Like most people who put value on their time I stopped mining and started looking elsewhere.

Trying His Hand at Bitcoin Exchanges in Poland

Back in 2011 there were very few Bitcoin exchanges around, most trades were arranged via forums on a one-to-one basis. I managed to find one exchange based in Poland which acted as a modern currency exchange, you could put bid/offer prices for Euros, Dollars, Pounds and Bitcoins.

I’m a big fan of learning by doing so I deposited £50 and bought approx 12 bitcoins. At this point I was more interested in learning about forex trading instead of Bitcoin.

I noticed that the buy price of BTC would sometimes be massively different to the sell price, the gap was big enough for me to try and make a profit trading. E.g. I would put in a buy order of £4.10 for a Bitcoin, and when somebody sold them to me I would instantly relist them for sale at £4.30.

I did this for a week and made a whopping grand total of £5 on top of my original £50 deposit!. So like my experiment with mining, I got bored and moved on. In the back of my head I always planned to return to this site at some later stage so just left the BTC sitting there… and then forgot about them.

When He Discovered He Now Had $5K In Digital Currency

Fast forward to early 2014 and whilst browsing BBC news I see BTC mentioned. I cant remember the exact article but it was talking about the Winklevoss twins investing their settlement money from sueing Facebook almost entirely in BTC (They are happy now but at the time they were down a few million with half the world thinking they were crazy.)

Heres a link for anyone wanting to know more details: http://money.cnn.com/2015/01/27/investing/bitcoin-winklevoss-twins-gold/index.html

*smug looking guys in suits warning*

After an hour or so of going far back through my e-mails I manage to find the website I had deposited money into and luckily for me I had left the funds in BTC (it was 50/50 whether I had finished my currency exchange learning experience with the funds in BTC or GBP)

I was now the proud owner of about $5000 worth of digital currency. The problem was then how to get it out of this site?

Trying to Figure Out How to Cash Out the Bitcoin for Money

BTC was still pretty new and there were very few legal frameworks for companies to operate under. Thousands of pounds being transfered between accounts would get flagged up in most countries so a lot of websites didnt have any easy options to transfer fiat currency out. The Polish currency exchange looked like it had seen better days, there hadn’t been any updates on the sites blog for months and there was only a handful of BTC being traded on the site.

So I Googled Bitcoin exchanges and moved my BTC onto a company called BTC-E. at the time it was a good move as the Polish website I used shut down soon after and I cant find any traces of it.

Moving it to BTC-E may not have been much of a smart move (more on that later.)

His $5k was Useless Because He Didn’t Have Proof of Address for BTC-E

BTC-E was much more active, there were millions of dollars worth of transactions happening and a few other cryptocurrences were being traded. I did try and cash out some of my funds but once again failed. BTC-E was linked to some 3rd party payment providers however when I joined them they wanted proof of address via a utility bill.

The problem is that I was living in rented accodomation and all the bills were in my landlords name. I was unable to use those documents so whilst I was happy to have discovered my £50 initial buy was now worth $5000 I was uable to spend it on anything.

I also tried to find out what the tax situation was at that time and couldnt find anything on the UK government website. BTC itself wasn’t taxed but if I suddenly transfered thousands into my account there was a chance that HMRC would want a share.

So He Decided to Buy Stuff in the Name of the Cause

Part of me really liked the idea of BTC and wanted to help it grow.

So I decided to leave it for a while in BTC-E hoping to maybe find things to spend it on without needing to convert it into pounds or dollars.

If you dont fancy delving into the dark web Bitcoin however seems to be only used to buy digital services such as VPN and webhosting, which I didn’t need.

There were a few random items for sale (e.g. Hand made luxury cuban heel shoes for $500 worth of BTC) but nothing I actually wanted.

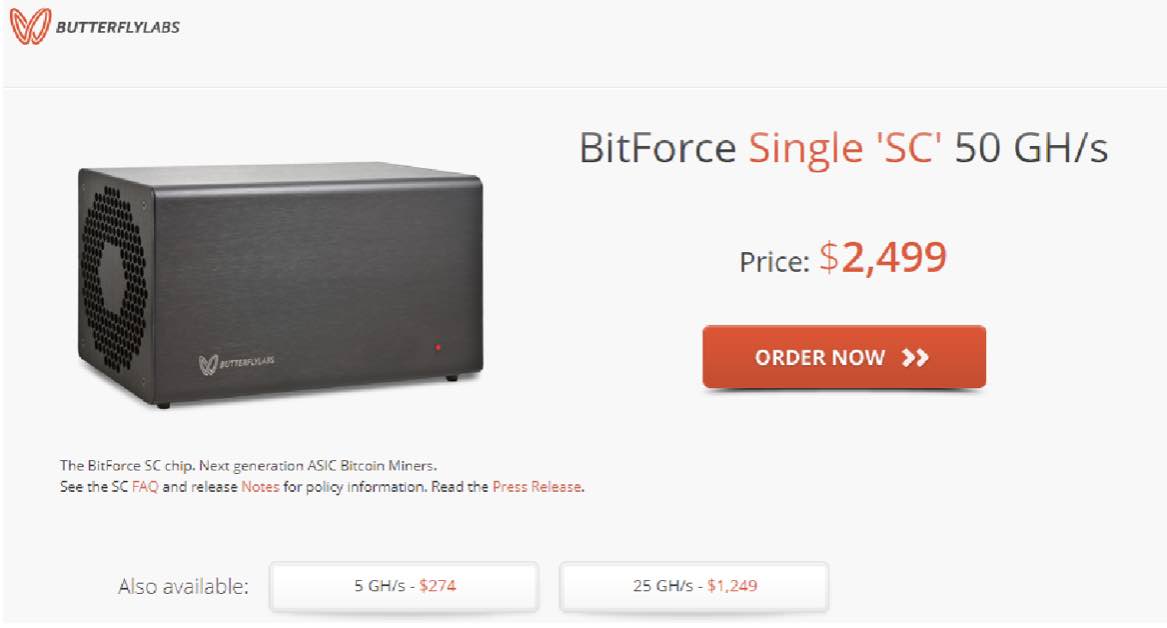

In Comes Butterfly Labs Which Offered a Bitcoin Mining Solution That Would Pay for Itself

Then Butterfly labs came along. Butterfly labs were a new company from America that were developing little “magic boxes” which specialised in mining bitcoins.

Up until this point people had been spending thousands of dollars on graphics cards for their computers to earn Bitcoins.

These new machines from Butterfly labs claimed to be able to pay for themselves in 1-2 weeks. I felt flush with money as my BTC were still going up in value and put in an order for one of the medium models which cost about £350 at the time.

The devices hadn’t actually been fully developed and manufactured yet, they were all preorders but butterfly labs started getting millions of dollars of orders for these boxes.

Some bigger players in the BTC world opted for the large versions costing thousands of dollars:

But Butterfly Labs Couldn’t Offer the ROI Promised on The Magic Box

Alarm bells started ringing when 2-3 months later the devices still hadn’t started to be shipped and the company forums were getting filled up with reports of the company ignoring customer e-mails. Eventually some of the devices did start getting shipped, however they were so far past the date the company had first stated that the difficulty of mining had gone up and made them nowhere near as useful as first promised.

Originally I had anticipated mine for 2 weeks before the device paid for itself (in hindsight that was too good to be true).

Once my box had arrived and was mining I calculated it would need to run for over a year to pay for itself.

My £350 “magic box”:

Bunny for scale:

I was still in rented accomodation so the thing had to operate in my bedroom and it wasn’t silent. Instead of subjecting myself to noisy sleep for the sake of pennies I unplugged it and forgot about BTC for a while.

I logged into BTC-E every now and then to see how things were going and if there were different options for me to try and cash out my money. At its peak my coins were worth $12,000 (approx £9300) which made it a 18600% ROI from the original £50 investment. Not bad for what was essentially luck.

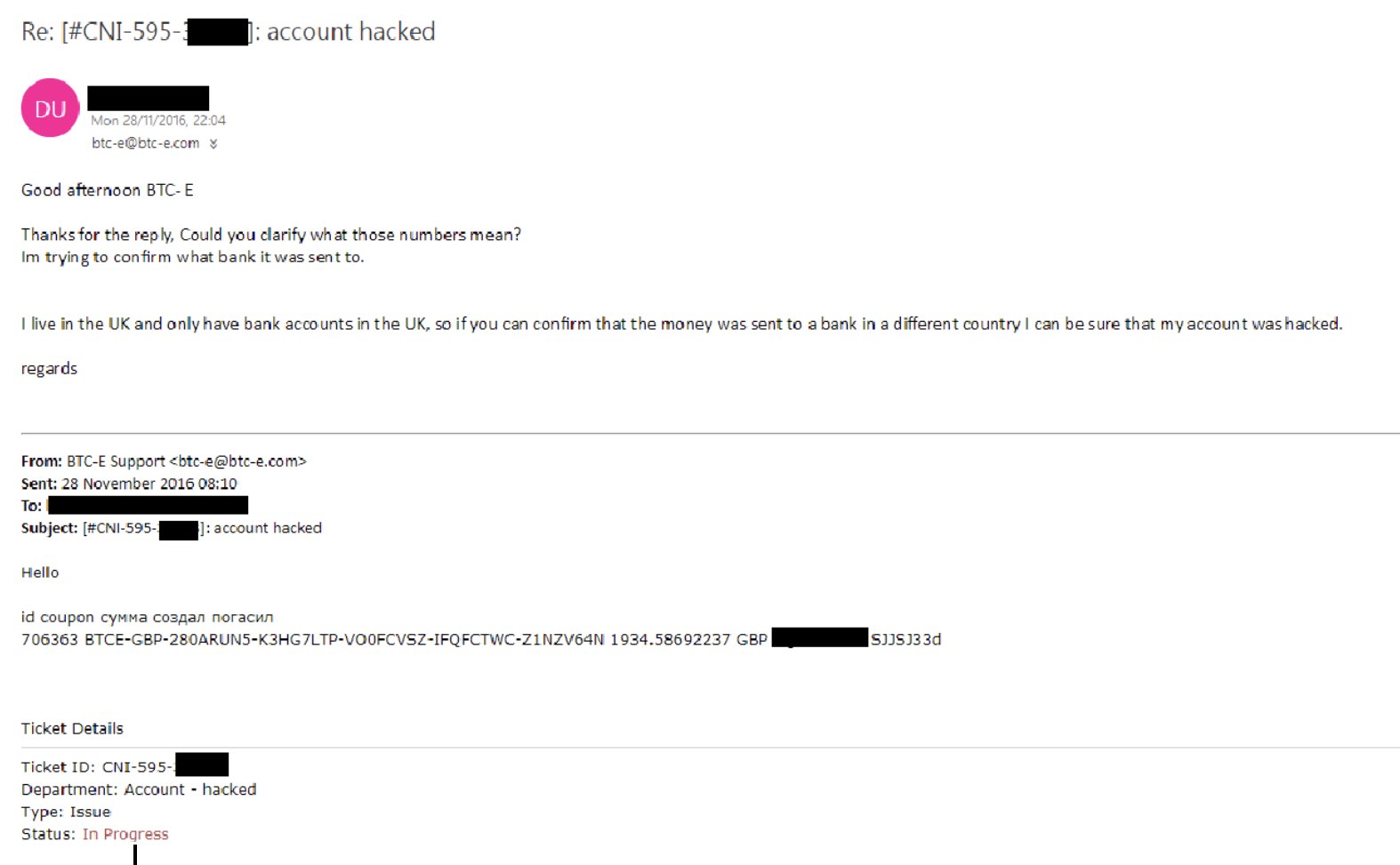

Butterfly Labs and BTC-E were Hacked

In 2014 disaster struck. Both BTC-E and Butterfly labs were hacked. Passwords and e-mail addresses as well as wallet balances were stolen. Nobody at BTC-E or Butterfly labs decided to tell any of their customers!

Im not sure exactly when that data was used to get into my account but it wasnt until mid 2016 when I logged into my account and noticed that everything had gone. All my BTC and funds were gone.

The records showed an IP address originating from the middle of the Pacific ocean had logged into my account at 4am a few months prior and cashed out all my BTC, then a different IP had logged in a few minutes later and cashed out the dollars. I spent a few hours looking around for more info and double checking I was looking at the right account.

Customer Service Sucks for Bitcoin Companies

Eventually I sent a message to the customer support and found out that BTC-E wasn’t the large reputable company I had assumed it was (they were dealing with millions of dollars in transactions.)

Their responses took days to come back and half the time were in Russian!

Bitcoin Has No Safety Net When Things Go Wrong

The main problem with Bitcoin is that there is no protection from things going wrong. If money gets lost from a bank account you have legal rights to claim it back. On the internet with no international borders or internet-police theres little you can do. I spent 4 months e-mailing back and forth with BTC-E trying to get somewhere. The wouldn’t even confirm to me which bank account or country the money had been moved to.

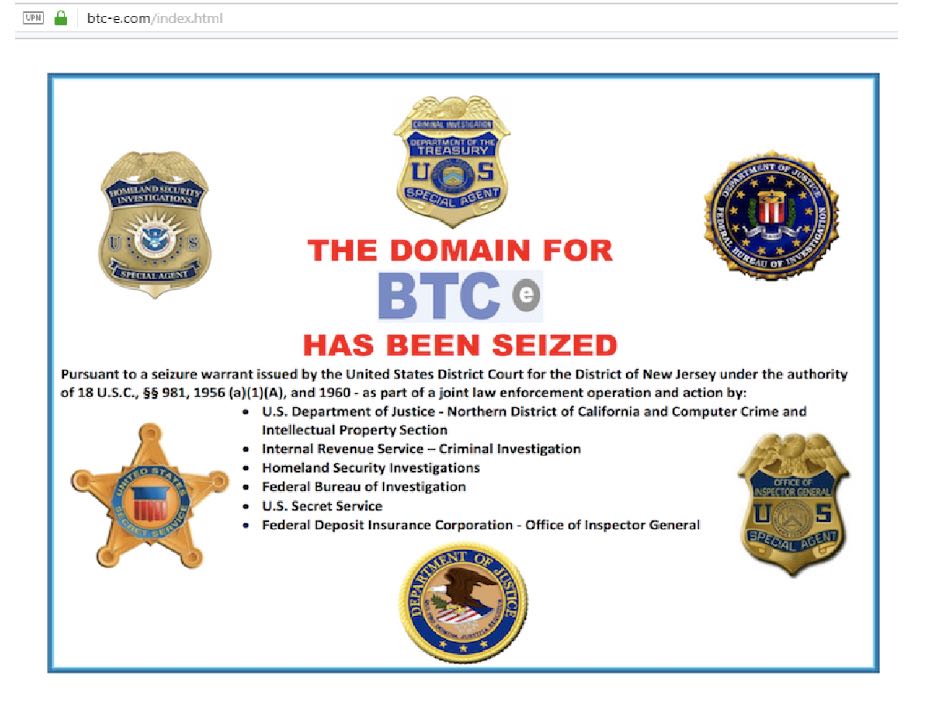

In researching this post I was hoping to show some screenshots from inside my BTC-E account as “proof” of what happened. However it seems im not the only one who lost out by using this exchange. As of a few weeks ago the owner is being looked into by the FBI for his role in the biggest BTC heist ever as well as various other offences including money laundering.

The FBI have taken over their website and the front page of one of the biggest exchanges ever now looks like this:

At this stage the chances of me recovering any of my bitcoins is close to 0.

Why He Doesn’t Currently Invest in Bitcoin

So whats the moral of the story?

Surprisingly, im not against BTC or other crypto currencies, I think its an interesting technology that will stay around for a while. I dont currently own any but thats because I have better things to invest in and Im sure that most BTC exchances still have the problem that its easy to put money in but hard to take it out. For now im going to sit by and watch.

Even though the value of the coins was up to £9300 at one point I only feel like I lost £400 (The original £50 deposit in 2011 and the magic box from Butterfly Labs). Ive learned a lot about crowd behaviour by watching the panics and rises in BTC. I might not have paid attention if I didnt have any and I also learned plenty about security regarding accounts and looking after your investments. Im fairly confident that the value of this knowledge will help save or make more than £400 over my lifetime.

I hope this story hasnt put anyone off at least researching more into BTC. If you take extra precautions (and dont accidentally give your money to a Russian con artist) you may end up being able to take part in something fun and profitable.

I’ll leave everyone with this popular BTC Gif which seems to summarise the feelings and experiences of plenty of people who tried to get involved with Bitcoin:

Check out Money Corgi’s site here: https://moneycorgi.com/

What do you think about bitcoin and other cryptocurrencies? Would you invest in them?

Be sure to sign up for our email list below if you liked this series. Also, we’re launching a podcast soon about early retirement called the Fire Drill Podcast. Be on the lookout for the launch announcement (or sign up HERE to be notified via email).

- How to Make a Backyard Movie Theater with a projector screen - September 19, 2020

- HONEST Passive Income Planner Girl by Michelle Rohr course review - May 25, 2020

- 35 Pink Aesthetic Wallpapers with Quotes and Collages - May 20, 2020

The Boo & I was just discussing internet currency – BITCOIN to be exact! I do not know much of anything about either subject (honestly). But, I do know having your money (real or crypto currencies) stolen is a NO BUENO.

Interesting article, nonetheless. Thanks.

I’ve been thinking about getting into it just to try it out, but definitely stories like this one make me nervous about it.

There are plenty of ways to make Bitcoins safe, the problem is that it requires you to go out of your way to protect yourself. where as with “regular” savings and investments you tend to have some sort of protection from the government.

Its possible to “download” your bitcoins to a USB stick and then keep that in your house. the chances of it getting stolen are lowered but the chances of losing the USB stick or it getting broken present different problems.

I think that Ethereum seems to show promise, and will probably make a small investment myself. The US-based Coinbase seems safe, and claims to have insurance in case it’s hacked (but not if your individual account is hacked because someone steals your password). In any case, I’m not putting in anything that I can’t afford to lose. It still feels very much like the “Wild West”.

So much opportunity and so much risk!

It very much is the wild west, the owner of the BTC-E exchange I lost my Bitcoins in is under investigation from the FBI for stealing millions from another rival exchange!

Harrowing tale, fortunately not a ton was at risk since it was paper gains… but still scary. These immature markets, where thieves can run rampant, are just too wild west for my tastes. The “returns” may be fantastic but you could just as easily get taken for a ride… I think the more these types of stories get out (and they’re rare, no one likes to tell a story about how they got robbed) the more enthusiasm for them will wane.

If these cryptocurrencies fizzle out, the concept of a blockchain will probably persist and that’s an innovation that is valuable. Too bad you can’t really “invest” in that concept as far as I know.

Hi Jim

Treating it as paper gains certainly makes the loss easier to take. The Bitcoins would be worth about $50,000 today, but I’m aware that’s all theoretical profit.

I also never thought of Bitcoins as an investment. I bought £50 worth years ago to learn about then and then got lucky by forgetting I owned them.

Easy come, easy go.