This post is from 2015.

So, do you want to get married tomorrow?

I asked my fiancé this question on Monday. We’ve been engaged for three and a half months now and are planning our wedding for next year.

Given that today is New Years Eve and I’m a personal finance nut, I have been of course thinking about taxes this week. (I made my Goodwill donation this morning with all the other psychos. Hellooo tax deduction!)

If marriage would give us a tax benefit, I’d consider getting married before year-end.

Turns out the fiancé was OK with it too. We decided that we’d do it if we could get a marriage bonus of $1000 or more.

So I looked into it.

Married Filing Separately or Head of Household

It doesn’t make sense to go the married filing separately route unless you have significant medical expenses (more than 10% of your Adjusted Gross Income) or another reason to file separately. For example, you aren’t eligible for the student loan interest deduction or other valuable credits and deductions if you file married filing separately. It did not make sense for us.

Head of household does not apply to us either although it’s a super valuable filing status for those who qualify. To qualify for Head of Household status you need to be providing over 50% of living costs for yourself and a qualifying dependent and that dependent needs to have made less than $4k that year.

How Does Marriage Affect Taxes?

Traditionally, couples with equal incomes get penalized by filing together. We are in two different tax brackets so we thought that it would benefit us to file together.

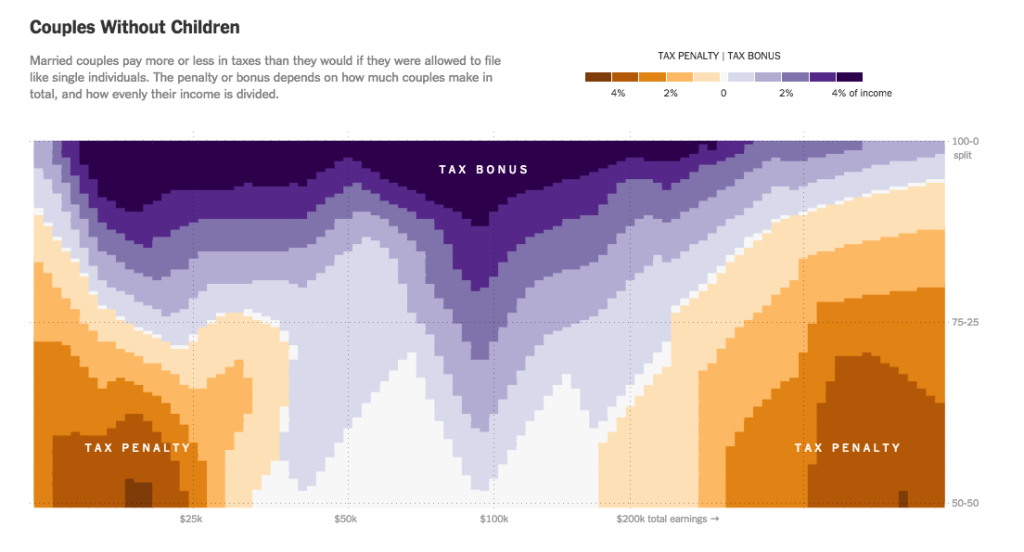

New York Times has an interactive version of the image below which shows whether you would receive a marriage tax bonus or penalty.

The horizontal access shows the total income for both partners and the vertical access shows the split of that income between partners.

The max bonus seems to apply when couples have an unequal split and incomes of around $100,000. The greatest penalty applies to couples who are around an equal split and really low incomes or really high incomes.

We fall somewhere in the lighter blue area so I investigated further.

Qualifying for Credits and Deductions When Married

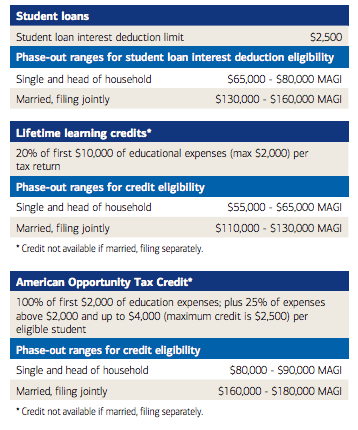

Together we may have a low enough Modified Adjusted Gross Income to qualify for the student loan interest deduction, the Lifetime Opportunity credit, and deductions for traditional IRA contributions. We didn’t both qualify for those credits and deductions separately.

In order to determine if this was true, I did a little research. Merrill Lynch has a nice contribution guide that shows the 2015 contribution limits for tax advantaged accounts and income limits for credits and deductions. The below images are from the guide.

Most of the income limits for married filers are double that of single filers – which is good for most people, except it doesn’t help us. We would not qualify for the valuable Lifetime Learning Credit or have the ability to deduct traditional IRA contributions when filing together. When we filed separately, one of us could claim those credits and deductions.

Additional bummer, you can only deduct $2500 for student loan interest when married filing jointly even though that is the amount that single filers can deduct. I was excited because I thought we could deduct up to $5000 in student loan interest together.

Marriage Bonus if Itemizing

Last item to investigate, how does itemizing affect taxes when married filing jointly?

When filing taxes, you can choose to itemize or take the standard deduction. You would choose to itemize when you have more expenses to deduct than the standard deduction. The single filer standard deduction is $6300 and the married standard deduction is $12,600.

We paid $17k in mortgage interest last year so we should itemize whether we file married filing jointly or separately.

Additionally, if one of us itemizes and the other takes the standard deduction, we would be looking at around a $23k deduction ($17,100 plus $6,300) versus a $17k deduction with just that one move.

If our mortgage interest was less than $6,300 it might make sense to file married filing jointly and take the standard deduction of $12,600 (when considering no other factors mentioned above).

Worth Getting Married for Tax Purposes?

Since we don’t get the tax credits and the extra student loan interest deduction that I had hoped for when filing married filing jointly AND the fact that we have such high mortgage interest, it didn’t make sense for us to file together.

I double checked using the H&R Block Tax Calculator and confirmed that we would actually see a marriage penalty of about $900 when filing together.

Conclusion – no eloping for us! Our parents will be thrilled 🙂

Readers, do you receive a marriage bonus or penalty? Would you ever get married or delay getting married for tax purposes?

- How to Make a Backyard Movie Theater with a projector screen - September 19, 2020

- HONEST Passive Income Planner Girl by Michelle Rohr course review - May 25, 2020

- 35 Pink Aesthetic Wallpapers with Quotes and Collages - May 20, 2020

Leave a Reply